Banking

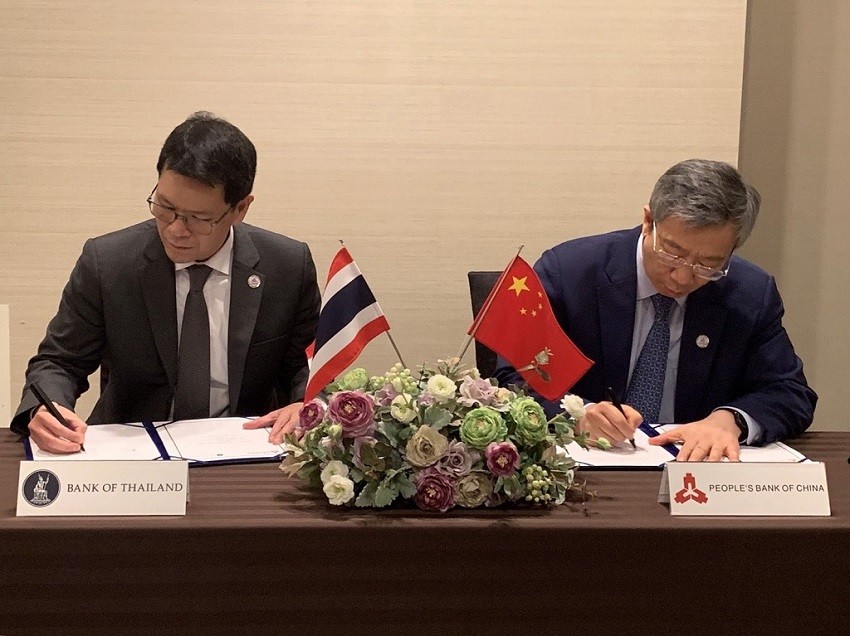

BoT and PBC sign agreement on Fintech Collaboration

The two central banks aim to promote the use of innovation and technology to reduce costs and improve efficiency of financial products and services.

On 9 June 2019 Mr. Veerathai Santiprabhob Governor of the Bank of Thailand (BOT) and Mr. Yi Gang Governor of the People’s Bank of China (PBC), signed a Fintech Co-operation Agreement in Fukuoka, Japan.

According to this agreement, the BOT and the PBC will collaborate on several issues, including:

(1) joint innovation projects and research,

(2) information sharing and

(3) regulatory coordination.

The BOT and the PBC share a common interest to create fintech-friendly ecosystems that support the advancement of innovations and technologies.

The two central banks aim to promote the use of innovation and technology to reduce costs and improve efficiency of financial products and services.

Source : Bank of Thailand

Banking

HSBC to Scale Back China Credit Card Operations Amid Expansion Challenges – Reuters

HSBC is withdrawing from its China credit card business due to difficulties in expanding, marking a strategic retreat in a challenging market environment.

HSBC’s Strategy Shift in China

HSBC is scaling back its credit card operations in China, highlighting challenges the bank has faced in expanding its customer base. The competitive landscape, combined with changing consumer preferences, has made it increasingly difficult for the bank to maintain its position in this lucrative market.

Market Challenges Ahead

Recent reports indicate that HSBC is reassessing its strategy, focusing resources on other areas where it sees stronger growth potential. The decision to pull back reflects the broader difficulties foreign banks encounter when trying to penetrate China’s financial services sector.

Future Focus

As HSBC pivots away from its credit card business in China, it aims to concentrate on digital banking and wealth management services. This strategic shift underscores the bank’s commitment to adapting to the evolving landscape of financial services while ensuring long-term sustainability in the region.

Source : Exclusive: HSBC pulling back from China credit card business after struggling to expand – Reuters

Banking

Bow to Beijing a low move by HSBC

HSBC has put money before morality to back China’s new security law: one that’s an assault on the freedoms of Hong Kong’s people.

Luckily for HSBC, it’s headquartered in Britain: a country where you can say what you like about Boris Johnson and his shambolic handling of the pandemic.

(more…)Banking

How China’s role in global finance has changed radically

Within the space of just 15 years, China has gone from being the largest net lender to the world to now being a net borrower. The implications for the global economy, and China’s role within that economy, could be significant.

‘If you owe the bank $1 million, you have a problem. But if you owe the bank $1 trillion, then the bank has a problem’. It’s an old gag, but it underscores an important point: the size of your borrowing or lending can have profound implications for your role in the world.

(more…)