Business

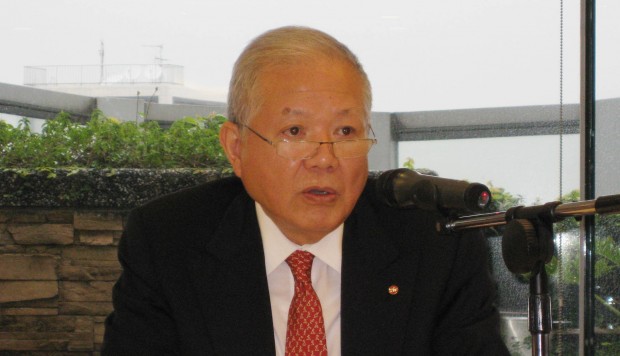

Head of Taiwan’s SinoPac bank held over US$165m ‘illegal loans’ to offshore company

The head of a major Taiwanese bank has been detained on suspicion of granting illegal loans, just months after another banking scandal rocked the island’s financial sector.

SinoPac Holdings chairman Ho Shou-chuan and two others are being probed over an alleged NT$5 billion (US$164.7 million) of loans made to an “offshore company with no real operations”.

It is not yet clear what relationship they have with the firm that received the money.

The case comes after the ex-chairman of Mega International Commercial Bank was indicted in December on charges including insider trading.

That followed a massive US$180 million fine slapped on Mega by United States authorities after they said they found “suspicious transactions” between its New York and Panama branches.

Taipei District Court on Sunday approved a request by prosecutors to take Sinopac’s Ho and the other two suspects into custody, saying there was a risk of evidence tampering or collusion.

Local prosecutors investigating the case searched Ho’s residence and office last week.

“(Ho) and the others are suspected of jointly violating laws including the Securities and Exchange Act and breach of trust,” prosecutors said.

No formal charges have been made yet.

China’s Minsheng Bank sees investor trust vanish – along with 3b yuan

The case revolves around alleged illegal lending to a company called J&R Trading by a SinoPac subsidiary since 2009.

Local media said the funds were routed to finance an investment into a commercial building in Shanghai.

According to the court statement, Ho insisted at most he is accountable for “administrative negligence” and did not cause the company any damage.

SinoPac held an emergency board meeting on Saturday and appointed an acting chairman following Ho’s arrest.

The bank said it will cooperate with the investigation and that its operations are continuing as normal.

Two other people critical in the probe have not been questioned yet as they are out of the country,…

Business

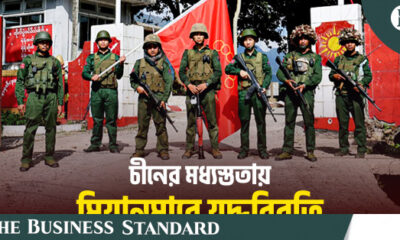

China Reports Agreement on Ceasefire between Myanmar’s Factions

Myanmar’s conflicting parties have reached a ceasefire agreement, facilitated by China, aiming to reduce violence and promote peace in the region.

Myanmar Ceasefire Agreement

In a significant development, conflicting parties in Myanmar have reached an agreement for a ceasefire, with China facilitating discussions. This breakthrough is crucial for restoring peace in a nation that has been marred by violence and political strife in recent years. The ceasefire aims to pave the way for reconciliation efforts and improve the humanitarian situation in affected areas.

Role of China

China’s involvement as a mediator highlights its growing influence in resolving regional conflicts. The Chinese government has been working closely with both sides to promote dialogue and trust, crucial elements for a long-term peace solution. Increased stability in Myanmar can benefit regional security and economic development, making China’s mediation significant.

Looking Forward

The hope is that this ceasefire will lead to further negotiations addressing underlying issues in Myanmar. While challenges remain, both parties have expressed willingness to work towards a peaceful resolution. The international community will be watching closely to see if this ceasefire can be sustained and lead to enduring peace for the people of Myanmar.

Business

China Limits Apple Operations as BYD Manufacturing Moves to India and Southeast Asia Amid Trade Frictions | International Business News – The Times of India

China is restricting the export of high-tech manufacturing equipment and personnel to India and Southeast Asia, aiming to maintain domestic production amid potential US tariffs, impacting companies like Foxconn and BYD.

China Curbs on High-Tech Manufacturing

China is intensifying restrictions on the movement of employees and specialized equipment essential for high-tech manufacturing in India and Southeast Asia. This measure aims to prevent companies from relocating production due to potential tariffs under the incoming US administration. Beijing has urged local governments to restrict technology transfers and export of manufacturing tools as part of this strategy.

Impact on Foxconn and Apple’s Strategy

Foxconn, Apple’s primary assembly partner, is facing challenges in sending staff and receiving equipment in India, which could impact production. Despite these hurdles, current manufacturing operations remain unaffected. The Chinese government insists it treats all nations equally while reinforcing its domestic production to mitigate job losses and retain foreign investments.

Broader Implications for India

Additionally, these restrictions affect electric vehicle and solar panel manufacturers in India, notably BYD and Waaree Energies. Although the measures are not explicitly targeting India, they complicate the business landscape. As foreign companies seek alternatives to China, these developments are likely to reshape manufacturing strategies amidst ongoing geopolitical tensions.

Business

EFIS Maroc and China Eastern Airlines Set to Launch Service Between Morocco and China

China Eastern Airlines and EFIS Maroc will launch three weekly flights between Casablanca and Shanghai via Marseille starting January 19, 2025, enhancing cargo logistics for Morocco-China trade, particularly in the automotive sector.

New Flight Route Launch

China Eastern Airlines has partnered with EFIS Maroc to introduce three weekly flights between Casablanca (CMN) and Shanghai (PVG) via Marseille (MRS). This service is set to commence on January 19, 2025, operating on Tuesdays, Fridays, and Sundays, using Boeing 787-900 aircraft with a capacity of 18 tonnes for cargo.

Supporting the Automotive Industry

The service aims to enhance logistical support for the automotive sector, facilitating the secure and timely transport of high-value components between Morocco and China. This new route will not only strengthen local supply chains but also promote economic growth and trade relations between Africa and Asia.

Innovative Cargo Solutions

Jean Ceccaldi, CEO of ECS Group, emphasized that this collaboration marks a significant achievement for EFIS Maroc. Leveraging advanced digital tools like Squair for customs optimization and CargoAi for booking, EFIS Maroc will enhance operational efficiency, ensuring a superior cargo management solution tailored for China Eastern Airlines.

Source : EFIS Maroc and China Eastern Airlines to launch Morocco-China service