Business

The Belt and Road Initiative reaches now 115 countries from 64 in 2013

Moody’s Investors Service says that against the background of China’s rising tensions with the US, China is increasingly looking to countries that participate in its Belt and Road Initiative (BRI) as an important source of export demand as well as a source of vital raw materials.

Moody’s Investors Service has published the following report: China’s Belt and Road Initiative Report Card: Deeper linkages, greater caution

“However, there are indications that China is becoming more selective in which BRI projects that it will pursue, as seen by the value of new Chinese-led BRI contracts and direct investment falling significantly for the first time in 2017,”

Michael Taylor, a Moody’s Managing Director and Chief Credit Officer for Asia Pacific.

Key findings

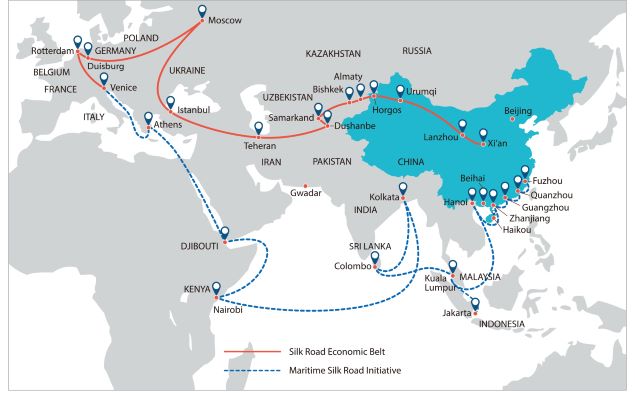

Moody’s points out that the number of countries forming part of the BRI has almost doubled to 115 from 64 when the BRI was first initiated in 2013.

The Belt and Road Initiative (BRI) continues to expand, It now encompasses 115 countries, from 64 in 2013.

There are indications that China is becoming more selective in which BRI projects it pursues as the value of new contracts in the BRI has significantly declined since 2016.

The change could be due to several factors, including tighter funding conditions in China and domestic political reactions in several BRI countries.

We expect the economic linkages formed through BRI projects to become more important to China as its relationship with the US sours.

The BRI provides China with a mechanism to develop relationships with recipient countries on trade, investment, regulatory standards, and through forging closer political alliances. An example is the Digital Silk Road, which represents China’s vision of global internet expansion through building telecom infrastructure, promoting internet services, cross boarder e-commerce and trading in tech goods.

Increasingly, China appears to look to Belt and Road (BR) countries as an important source of export demand as well as a source of vital raw materials.

Over time, we expect BR countries to grow in importance in global supply chains as processing and transportation centers. Improved manufacturing capabilities could foster their export of final value-added goods. Rising costs in China could drive a gradual shift of production from China to some BR countries in Southeast Asia.

BRI remains predominately debt-financed, with Chinese entities, particularly policy banks and state-owned enterprises (SOEs), the largest source of funding.

While many BRI countries are comparatively high credit risk, being either speculative grade or unrated, about 40% of the total value of these Chinese direct investments and projects is concentrated in top 10th percentile BR countries, with external debt levels around or below 50% of GDP.

Large reliance on Chinese funding could worsen some BR host countries’ debt affordability, leading to weaker sovereign creditworthiness.

If invested wisely, BRI funds have the potential to promote productivity and economic growth of BR countries through infrastructure improvement. However, external vulnerabilities, balance of payment pressure and high leverage have been challenging the credit quality of some BRI host sovereigns. Several have a larger than average reliance on Chinese funding. Most Chinese lending in BRI is likely to be on less concessional terms than offered by multinational institutions on average. Maturity of these loans is still long, varying from 12 to 20 years.

Data transparency remains a challenge

in calculating debt levels of some BR countries and understanding the real cost of Chinese funding. Unlike those of multilateral official creditors, Chinese lending terms lack conditionality on economic and governance reforms, which may limit the long-term economic benefits to BR countries

Business

China Limits Apple Operations as BYD Manufacturing Moves to India and Southeast Asia Amid Trade Frictions | International Business News – The Times of India

China is restricting the export of high-tech manufacturing equipment and personnel to India and Southeast Asia, aiming to maintain domestic production amid potential US tariffs, impacting companies like Foxconn and BYD.

China Curbs on High-Tech Manufacturing

China is intensifying restrictions on the movement of employees and specialized equipment essential for high-tech manufacturing in India and Southeast Asia. This measure aims to prevent companies from relocating production due to potential tariffs under the incoming US administration. Beijing has urged local governments to restrict technology transfers and export of manufacturing tools as part of this strategy.

Impact on Foxconn and Apple’s Strategy

Foxconn, Apple’s primary assembly partner, is facing challenges in sending staff and receiving equipment in India, which could impact production. Despite these hurdles, current manufacturing operations remain unaffected. The Chinese government insists it treats all nations equally while reinforcing its domestic production to mitigate job losses and retain foreign investments.

Broader Implications for India

Additionally, these restrictions affect electric vehicle and solar panel manufacturers in India, notably BYD and Waaree Energies. Although the measures are not explicitly targeting India, they complicate the business landscape. As foreign companies seek alternatives to China, these developments are likely to reshape manufacturing strategies amidst ongoing geopolitical tensions.

Business

EFIS Maroc and China Eastern Airlines Set to Launch Service Between Morocco and China

China Eastern Airlines and EFIS Maroc will launch three weekly flights between Casablanca and Shanghai via Marseille starting January 19, 2025, enhancing cargo logistics for Morocco-China trade, particularly in the automotive sector.

New Flight Route Launch

China Eastern Airlines has partnered with EFIS Maroc to introduce three weekly flights between Casablanca (CMN) and Shanghai (PVG) via Marseille (MRS). This service is set to commence on January 19, 2025, operating on Tuesdays, Fridays, and Sundays, using Boeing 787-900 aircraft with a capacity of 18 tonnes for cargo.

Supporting the Automotive Industry

The service aims to enhance logistical support for the automotive sector, facilitating the secure and timely transport of high-value components between Morocco and China. This new route will not only strengthen local supply chains but also promote economic growth and trade relations between Africa and Asia.

Innovative Cargo Solutions

Jean Ceccaldi, CEO of ECS Group, emphasized that this collaboration marks a significant achievement for EFIS Maroc. Leveraging advanced digital tools like Squair for customs optimization and CargoAi for booking, EFIS Maroc will enhance operational efficiency, ensuring a superior cargo management solution tailored for China Eastern Airlines.

Source : EFIS Maroc and China Eastern Airlines to launch Morocco-China service

Business

China Considers Selling TikTok US Operations to Musk as a Viable Option – Bloomberg

China is considering the sale of TikTok’s U.S. operations to Elon Musk as a potential option, according to a report by Bloomberg.

Potential Sale of TikTok to Elon Musk

Reports suggest that China is considering the sale of TikTok’s U.S. operations to Elon Musk as a viable option. This development follows ongoing scrutiny over the app’s data privacy practices and its links to the Chinese government. Officials believe that a sale could alleviate international concerns and preserve the platform’s presence in the U.S. market.

Strategic Implications

The potential transaction raises numerous strategic implications, not only for TikTok but also for Musk’s other ventures. If Musk were to acquire TikTok, it could enhance his digital footprint and provide new avenues for advertising and user engagement. Conversely, it could pose challenges in managing regulatory compliance and addressing data security issues.

Regulatory Hurdles Ahead

Despite the intriguing prospect of a sale, significant regulatory hurdles remain. Any acquisition would require approval from U.S. authorities, who continue to assess the risks associated with foreign ownership of tech companies. The outcome of these discussions could have widespread ramifications for both TikTok and the broader social media landscape.

Source : China Weighs Sale of TikTok US to Musk as a Possible Option – Bloomberg