Business

Dispute resolution along the Belt and Road

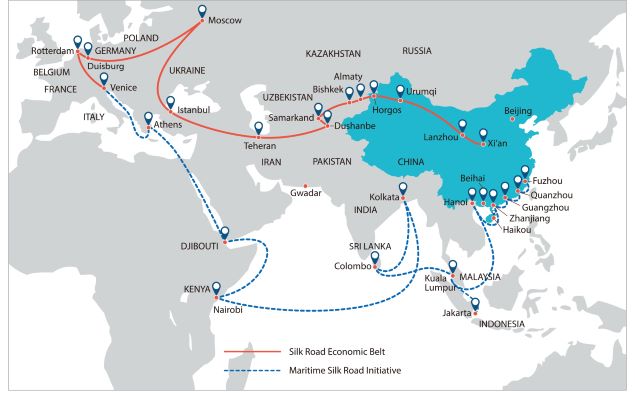

The prospect of disputes arising in respect of projects under China’s Belt and Road Initiative (BRI) has generated considerable interest, accompanied by positioning on the part of governments, government institutions, lawyers and academics who see potential opportunities.

The BRI is, of course, a very amorphous concept. Although primarily associated with infrastructure construction, which tends to involve large Chinese companies and Chinese funding, projects along the Belt and Road also involve governments other than the Chinese government and don’t necessarily include Chinese parties.

There are already a significant number of competing options available for the resolution of disputes arising from BRI projects — domestic courts, nominated foreign courts, domestic arbitration institutions, international arbitration institutions, ad hoc options, mediation institutions, investor-state arbitration under the auspices of the International Centre for the Settlement of Investment Disputes (ICSID) and so on.

The Chinese government’s also actively interested in strengthening Chinese institutions’ participation in BRI dispute resolution. A range of options for the law to govern contracts and related disputes is also available, due to the generally recognised autonomy of the parties to a contract to nominate the law governing the contract.

These include the law of the host state, which may well prefer major infrastructure contracts to be governed by the law where the infrastructure is located, the law favored by the lenders or contractors, or the law of a neutral third party such as English or Hong Kong law. There may be a mixture of different laws when a project involves a range of contractors and contracts. Logically, the law selected should also affect the location and method of commercial dispute settlement. However, this is not a requirement, and both arbitration institutions and courts are anxious to show that they are competent to deal with disputes which are subject to foreign law.

Further complicating the picture, an investment treaty may specify the governing law for claims by investors against the host state as part of the substantive commitments in the treaty. There are many methods of arbitrating commercial disputes in the Asia Pacific, including recourse to the major arbitration institutions. The China International Economic and Trade Arbitration Commission (CIETAC), the Hong Kong International Arbitration Centre (HKIAC), the Singapore International Arbitration Centre and the International Chamber of Commerce and others have taken steps to highlight their international experience, and their ability and willingness to handle BRI disputes. The development of international commercial courts is intended to challenge international commercial arbitration as the preferred dispute resolution method of choice in Asia. Singapore led the way by setting up the Singapore International Commercial Court which offers the services of expert judges from a range of jurisdictions, flexibility in using foreign law and rules of evidence, foreign legal representation and, if desired, appeals on legal grounds.

The so-called Chinese ‘Belt and Road’ court (the Chinese International Commercial Court) offer highly experienced and internationalised Chinese commercial judges, so-called one stop diversified dispute resolution and improved procedures for the proof of foreign law, but in accordance with Chinese law do not involve foreign judges. In Hong Kong, foreign judges serve on the Court of Final Appeal. Pursuant to a recent arrangement with China, civil commercial judgments of Hong Kong courts will soon be enforceable in China, where enforcement of foreign judgments is otherwise a difficult task. Dispute resolution along the Belt and Road | East Asia Forum

Business

EFIS Maroc and China Eastern Airlines Set to Launch Service Between Morocco and China

China Eastern Airlines and EFIS Maroc will launch three weekly flights between Casablanca and Shanghai via Marseille starting January 19, 2025, enhancing cargo logistics for Morocco-China trade, particularly in the automotive sector.

New Flight Route Launch

China Eastern Airlines has partnered with EFIS Maroc to introduce three weekly flights between Casablanca (CMN) and Shanghai (PVG) via Marseille (MRS). This service is set to commence on January 19, 2025, operating on Tuesdays, Fridays, and Sundays, using Boeing 787-900 aircraft with a capacity of 18 tonnes for cargo.

Supporting the Automotive Industry

The service aims to enhance logistical support for the automotive sector, facilitating the secure and timely transport of high-value components between Morocco and China. This new route will not only strengthen local supply chains but also promote economic growth and trade relations between Africa and Asia.

Innovative Cargo Solutions

Jean Ceccaldi, CEO of ECS Group, emphasized that this collaboration marks a significant achievement for EFIS Maroc. Leveraging advanced digital tools like Squair for customs optimization and CargoAi for booking, EFIS Maroc will enhance operational efficiency, ensuring a superior cargo management solution tailored for China Eastern Airlines.

Source : EFIS Maroc and China Eastern Airlines to launch Morocco-China service

Business

China Considers Selling TikTok US Operations to Musk as a Viable Option – Bloomberg

China is considering the sale of TikTok’s U.S. operations to Elon Musk as a potential option, according to a report by Bloomberg.

Potential Sale of TikTok to Elon Musk

Reports suggest that China is considering the sale of TikTok’s U.S. operations to Elon Musk as a viable option. This development follows ongoing scrutiny over the app’s data privacy practices and its links to the Chinese government. Officials believe that a sale could alleviate international concerns and preserve the platform’s presence in the U.S. market.

Strategic Implications

The potential transaction raises numerous strategic implications, not only for TikTok but also for Musk’s other ventures. If Musk were to acquire TikTok, it could enhance his digital footprint and provide new avenues for advertising and user engagement. Conversely, it could pose challenges in managing regulatory compliance and addressing data security issues.

Regulatory Hurdles Ahead

Despite the intriguing prospect of a sale, significant regulatory hurdles remain. Any acquisition would require approval from U.S. authorities, who continue to assess the risks associated with foreign ownership of tech companies. The outcome of these discussions could have widespread ramifications for both TikTok and the broader social media landscape.

Source : China Weighs Sale of TikTok US to Musk as a Possible Option – Bloomberg

Business

China and the UK Resume Economic and Financial Discussions After Six-Year Break

China and Britain resumed economic talks after six years, aiming to improve relations. Chancellor Reeves seeks cooperation but raises concerns over Russia’s support and Hong Kong’s civil liberties.

Resumption of Talks

Taipei, Taiwan (AP) — China and the United Kingdom have reignited economic discussions after a six-year pause, spurred by British Treasury Chief Rachel Reeves’ recent visit to Beijing. The Labour government aims to mend strained relations with China, the world’s second-largest economy. Reeves met with Chinese leaders and underscored the necessity for a "stable, pragmatic" partnership, emphasizing collaboration on mutual interests while maintaining transparency in disagreements.

Economic Collaboration

During her talks, Reeves sought to address key issues such as reducing economic support to Russia and advocating for basic rights in Hong Kong. Both nations signed agreements expected to infuse £600 million ($732 million) into the U.K. economy over the next five years. These agreements target crucial sectors including finance, with Reeves emphasizing that this renewed engagement may generate up to £1 billion for the U.K.

National Security Concerns

While seeking better ties, there are mounting concerns regarding national security and human rights abuses in China. Critics from the opposition have questioned the balance between economic opportunities and safeguarding Britain’s interests. Reeves acknowledged the importance of national security but highlighted the need for pragmatic relations with global partners, stating that ignoring China is not a viable option for the U.K.’s economic future.

Source : China and the UK restart economic and financial talks after a 6-year hiatus