China

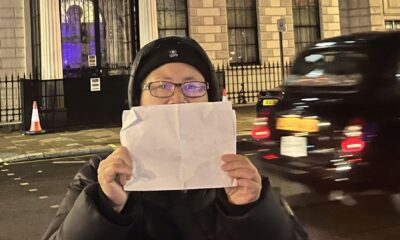

Writing China: James Jiann Hua To, ‘Qiaowu: Extra-Territorial Policies for the Overseas Chinese’

CRT spoke with political scientist James Jiann Hua To about China’s efforts to shepherd Chinese students, business executives and travelers when they’re overseas.

CRT spoke with political scientist James Jiann Hua To about China’s efforts to shepherd Chinese students, business executives and travelers when they’re overseas.

Cumulative appreciation of the renminbi against the US dollar since the end of the dollar peg was more than 20% by late 2008, but the exchange rate has remained virtually pegged since the onset of the global financial crisis.

In 2009, the global economic downturn reduced foreign demand for Chinese exports for the first time in many years.

China is the world’s fastest-growing major economy, with an average growth rate of 10% for the past 30 years.

Some economists believe that Chinese economic growth has been in fact understated during much of the 1990s and early 2000s, failing to fully factor in the growth driven by the private sector and that the extent at which China is dependent on exports is exaggerated.

The country is one of the world’s largest producers of a number of industrial and mineral products, including cotton cloth, tungsten, and antimony, and is an important producer of cotton yarn, coal, crude oil, and a number of other products.

China has acquired some highly sophisticated production facilities through trade and also has built a number of advanced engineering plants capable of manufacturing an increasing range of sophisticated equipment, including nuclear weapons and satellites, but most of its industrial output still comes from relatively ill-equipped factories.

China’s ongoing economic transformation has had a profound impact not only on China but on the world.

The ministry made the announcements during a press conference held in Xiamen on the upcoming United Nations Conference on Trade and Development (UNCTAD) World Investment Forum and the 14th China International Fair for Investment and Trade.

Last year was the eighth consecutive year that the nation’s ODI had grown.

It also aims to sell more than 15 million of the most fuel-efficient vehicles in the world each year by then.

In large part as a result of economic liberalization policies, the GDP quadrupled between 1978 and 1998, and foreign investment soared during the 1990s.

Since the late 1970s, China has decollectivized agriculture, yielding tremendous gains in production.

In terms of cash crops, China ranks first in cotton and tobacco and is an important producer of oilseeds, silk, tea, ramie, jute, hemp, sugarcane, and sugar beets.

China ranks first in world production of red meat (including beef, veal, mutton, lamb, and pork).

Offshore exploration has become important to meeting domestic needs; massive deposits off the coasts are believed to exceed all the world’s known oil reserves.

There are also deposits of vanadium, magnetite, copper, fluorite, nickel, asbestos, phosphate rock, pyrite, and sulfur.

In addition, implementation of some reforms was stalled by fears of social dislocation and by political opposition, but by 2007 economic changes had become so great that the Communist party added legal protection for private property rights (while preserving state ownership of all land) and passed a labor law designed to improve the protection of workers’ rights (the law was passed amid a series of police raids that freed workers engaged in forced labor).

The iron and steel industry is organized around several major centers (including Anshan, one of the world’s largest), but thousands of small iron and steel plants have also been established throughout the country.

Read the original here:

Writing China: James Jiann Hua To, ‘Qiaowu: Extra-Territorial Policies for the Overseas Chinese’

Business

US Companies Overlook China as a Viable Business Opportunity Amid Growing Challenges – Organiser

US businesses are increasingly overlooking China as a viable market due to escalating challenges, leading to a shift in focus toward alternative opportunities and partnerships.

Declining Interest in Chinese Markets

US businesses are increasingly viewing China as a less viable opportunity due to a rising number of challenges. Economic uncertainties, regulatory hurdles, and geopolitical tensions are among the key factors that have contributed to this shift in perspective. Companies that once saw China as a prime destination for investment are now reassessing their strategies and looking elsewhere.

Shift in Business Strategies

Many American firms are pivoting their focus to more stable markets. This realignment is driven by the need to reduce risk in their global supply chains and diversify their operations. As a result, countries in Southeast Asia and Latin America are becoming attractive alternatives for US businesses in search of new opportunities.

Long-Term Implications

This trend could have significant long-term implications for both economies. The diminished interest in China might alter the landscape of global trade and investment patterns. As US companies seek to mitigate risks, there could be lasting effects on China’s market growth and its role as a manufacturing hub.

Source : US businesses dismiss China as a business opportunity amid rising challenges – Organiser

Business

Tesla Sales Slow Down as China’s BYD Gains Ground

Tesla’s sales dipped 1% in 2024, marking its first decline in over a decade, while BYD surged with 1.76 million EV sales, narrowing the competition gap.

Tesla’s Sales Decline

Tesla has faced its first sales decline in over ten years, with 2024 deliveries falling to nearly 1.79 million vehicles, a 1% drop from 2023. Despite aggressive price cuts to attract buyers, the company led by Elon Musk struggled to maintain its position as the top electric vehicle (EV) manufacturer. In contrast, China’s BYD is on track to nearly close the gap, reporting 1.76 million EV sales in 2024.

BYD’s Market Surge

BYD experienced robust growth, achieving a 41% year-on-year increase in total vehicle sales, totaling over 4.2 million. Most of BYD’s sales occur in China, where the company has extended its lead over brands like Volkswagen and Toyota. The rise has been fueled by increasing demand for hybrids and favorable market conditions, including reduced prices and government incentives for EV adoption.

Industry Challenges

Tesla continues to grapple with declining sales and increased competition, particularly in China, where rivals have gained traction. The EV market is softening in regions such as the US and Europe, prompting companies like Ford and Volkswagen to adjust their sales forecasts. Additionally, geopolitical tensions have led to tariffs against Chinese imports, impacting the industry landscape.

China

Latest Adjustments to Import-Export Tariffs in China for 2025

The State Council has announced 2025 import-export tariff adjustments to enhance domestic demand and industrial growth. This includes tariff reductions on medical supplies and green products, increases on certain commodities, and support for technological innovation and sustainable practices.

The State Council has announced new adjustments to the China import-export tariffs for 2025 to expand domestic demand and serve industrial development and technological progress in the coming year.

These adjustments include tariff reduction on certain medical supplies, critical equipment and key parts, and green products, tariff increases on certain commodities based on domestic demands such as syrup and sugar-containing premixes, vinyl chloride, and battery separators, as well as adjustments to tariff items.

China will adjust import and export tariffs on selected goods in 2025 in a bid to expand domestic demand, support high-quality development and opening up, and enhance the synergy between domestic and international markets, the Customs Tariff Commission of the State Council (the ‘Commission’) said on Saturday, December 28, 2024.

Below we take a closer look at the changes introduced in the 2025 Tariff Adjustment Plan.

To promote technological innovation and support the development of new and advanced productive forces, China will reduce import tariffs on key items, including automatic transmissions for special-purpose vehicles, polyolefin polymers, ethylene-vinyl alcohol copolymers, fire trucks, and rescue vehicles.

In alignment with efforts to enhance and improve public well-being, tariff reductions will also be applied to critical medical and healthcare materials such as sodium zirconium cyclosilicate, viral vectors for CAR-T cancer therapy, and nickel-titanium alloy wires for surgical implants.

To foster green and low-carbon development, import tariffs on ethane and certain recycled copper and aluminum materials will be lowered, encouraging sustainable practices and resource efficiency.

| This article was first published by China Briefing , which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in in China, Hong Kong, Vietnam, Singapore, and India . Readers may write to info@dezshira.com for more support. |

Read the rest of the original article.