China

Trust building pivotal to US–Pacific Islands relations

Abstract

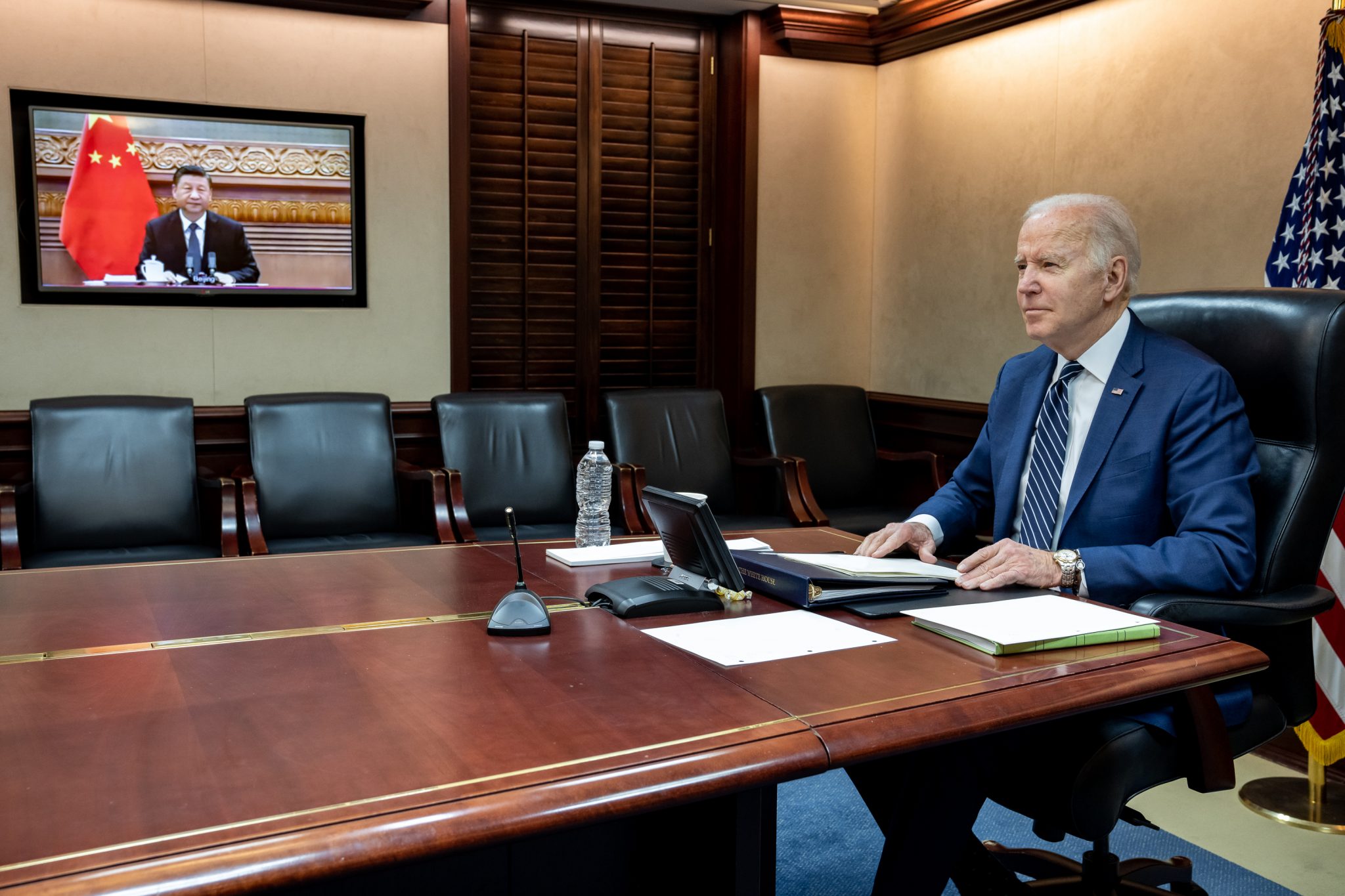

The United States needs to gain the trust of Pacific Island countries in order to effectively engage with them. China’s expanding presence in the region should not be the sole motivation for cooperation. The Pacific Islands are crucial for US security, prosperity, and efforts against climate change. However, the lack of confidence in the US and perception of its engagement as a reaction to China’s expansion may hinder cooperation. China’s involvement in the Pacific has surpassed that of the US, and its expansion suggests potential for increased naval presence. The recent China-Solomon Islands security pact highlights the possibility of a Chinese naval base in the South Pacific. The Biden administration’s Pacific Partnership Strategy should not be solely focused on countering China, but needs to prove its commitment through practical action and financial resources. If the US fails to meet its commitments, Pacific Islanders may turn to Chinese assistance.

The United States is focusing on the challenges posed by China’s growing presence in the Pacific. However, winning the trust of the Pacific Island countries should be Washington’s top priority to ensure genuine cooperation. The Pacific Islands are crucial to US security and prosperity, and they lead in the fight against climate change. Cooperation with the Pacific is hindered by the lack of confidence in the United States, as it is often seen as a reaction to China’s expansion in the region.

China has increasingly become involved in the Pacific through various diplomatic strategies and aid programs, surpassing US assistance. China’s commitment extends to multilateral engagement, but it has not gained support from Pacific Islands Forum leaders. China’s expansion also suggests the potential for a naval presence, as seen in the China-Solomon Islands security pact.

The Biden administration has announced the Pacific Partnership Strategy, but if countering China remains the main motivation for engagement, the partnership is unlikely to reach its full potential. To demonstrate its commitment, the United States must provide financial resources to Pacific nations. While the Biden administration has proposed funding, it has not yet been delivered. Doubts may arise about the long-term viability of the strategy if commitments are not met, leaving Pacific Islanders open to considering Chinese assistance.

Business

Procter & Gamble’s Stock Upgraded to Buy on Stronger Performance in China – MarketWatch

Procter & Gamble’s stock received a “buy” upgrade due to improvements in its China business, indicating positive market sentiment and potential for growth.

Procter & Gamble’s Stock Upgrade

Procter & Gamble (P&G) has received an upgraded stock rating, now classified as a "buy" due to promising developments in its China operations. Analysts have observed a rebound in sales within the Chinese market, which has been a significant factor in the company’s overall performance. The resurgence in consumer demand is expected to bolster P&G’s growth trajectory.

Positive Market Sentiment

The positive sentiment surrounding P&G’s stock can be attributed to its strategic initiatives aimed at reinforcing market presence in Asia. The company’s commitment to enhancing its product offerings and aligning with local consumer preferences has proven effective. As P&G continues to adapt, investors are optimistic about its profitability and sustainability in the competitive landscape.

Future Prospects

Looking ahead, P&G’s focus on innovative marketing and product diversification is likely to sustain its growth momentum. The upgrade reflects confidence in the company’s ability to navigate market fluctuations and leverage emerging opportunities. Overall, P&G appears well-positioned for continued success in both domestic and international markets.

Source : Procter & Gamble’s stock upgraded to buy as its China business is perking up – MarketWatch

China

Strengthening Economic Relations and Opportunities Between China and Malaysia

Malaysia, strategically located in Southeast Asia, is a vital gateway to ASEAN markets. In 2023, China remained Malaysia’s largest trading partner, with bilateral trade at US$190.24 billion, despite a slight decline. China is also the top source of tourists for Malaysia.

Malaysia is strategically located at the heart of Southeast Asia and serves as a gateway to ASEAN’s 650 million people and a combined GDP of US$3.2 trillion. Its geographical advantage positions it as a hub for accessing ASEAN markets and connecting to the Middle East, Australia, and New Zealand.

In 2023, bilateral trade between China and Malaysia amounted to US$190.24 billion. Of this, China’s exports to Malaysia totaled US$87.38 billion, while imports from Malaysia reached US$102.86 billion. China has remained Malaysia’s largest trading partner for 15 consecutive years. Major imports from Malaysia include integrated circuits, computers and their components, palm oil, and plastic products. Key Chinese exports to Malaysia consist of computers and their components, integrated circuits, apparel, and textiles.

China has implemented a unilateral 15-day visa exemption policy for ordinary Malaysian passport holders, while Malaysia offers 30-day visa-free entry for Chinese citizens. According to Malaysian statistics, over 1.47 million Chinese tourists visited Malaysia in 2023, maintaining China’s position for the seventh consecutive year as Malaysia’s largest source of tourists outside ASEAN.

Malaysia was China’s 10th largest global trading partner and the second largest within ASEAN. However, due to factors such as the decline in international commodity prices (including palm oil and natural gas), uncertainties arising from geopolitical conflicts, and a high base from the previous year, China-Malaysia bilateral trade experienced a slight decline in 2023, decreasing by 5.2 percent year on year.

Despite these fluctuations, China remains Malaysia’s primary source of imports and second-largest export destination, underscoring the deep economic ties between the two nations and Malaysia’s pivotal role as China’s second-largest ASEAN trading partner.

China-Malaysia Trade Value, 2019-2023

| This article was first published by China Briefing , which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in in China, Hong Kong, Vietnam, Singapore, and India . Readers may write to info@dezshira.com for more support. |

Read the rest of the original article.

China

Three lessons the west can learn from China’s economic approach to AI

AI is transforming various sectors globally, but adoption differs. China prioritizes speed and practicality, embracing imperfections. The West, seeking perfection, can learn from China’s pragmatic approach to AI integration.

AI is already everywhere, ready to change the way we work and play, how we learn and how we are looked after. From hospitality to healthcare, entertainment to education, AI is transforming the world as we know it.

But it’s developing at a different pace in different parts of the world. In the west, it seems, there is a tendency to aim for perfection, with companies taking their time to refine AI systems before they are implemented.

China, on the other hand, has taken a more pragmatic path, on which speed and adaptability are prioritised over flawless execution. Chinese companies appear more willing to take risks, accept AI’s current limitations and see what happens.

And China’s desire to be the world leader in AI development seems to be working. Here are three important lessons the west can learn from China’s economic strategy towards AI.

1. Embrace imperfection

Many Chinese companies have adopted a “good enough” mentality towards AI, using it even when the technology is not fully developed. This brings risks, but also encourages fast learning.

For example, in 2016, Haidilao, a popular Chinese restaurant chain, introduced “Xiaomei”, an AI system which dealt with customers calling up to make reservations. While Xiaomei is not the most sophisticated AI system (it only understands questions about reservations), it was effective, managing over 50,000 customer interactions a day with a 90% accuracy rate.

It’s not perfect, but it provides a valuable service to the business, proving that AI doesn’t need to be flawless to make a big impact.

2. Make it practical

A key distinction between AI strategies in China and the west is the focus on practical, problem-solving applications. In many western industries, AI is often associated with cutting-edge technology like robot-assisted surgery, or complex predictive algorithms.

While these advances are exciting, they do not always bring immediate impact. China, by contrast, has made significant strides by applying AI to solve more basic needs.

In China, some hospitals use AI to help with routine – but very important – tasks. For instance, in April 2024, Wuhan Union Hospital introduced an AI patient service which acts as a kind of triage nurse for patients using a messaging app.

Patients are asked about their symptoms and medical history. The AI then evaluates the severity of their needs, and prioritises appointments based on urgency and the medical resources available at that time. The results are then relayed to a human doctor who makes the final decision about what happens next.

By helping to ensure that those with the most critical needs are seen first, the system plays a crucial role in improving efficiency and reducing waiting times for patients seeking medical attention. It’s not the most complex technology, but in its first month of use in the hospital’s breast clinic, it reportedly provided over 300 patients with extra consultation time – 70% of whom were patients in urgent need of surgery.

3. Learn from mistakes

China’s rapid adoption of AI hasn’t come without challenges. But failures serve as critical learning experiences.

One cautionary tale over AI implementation comes not from China, but from Japan. When Henn na Hotel in Nagasaki became the world’s first hotel staffed by robots, it received a great deal of attention for its futuristic concept.

But the reality soon fell short of expectations. Churi, the hotel’s in-room assistant robot, frequently misunderstood guest requests, leading to confusion. One guest was reportedly woken up repeatedly because a robot in his room mistakenly understood the sound of his snoring to be a question.

In contrast, many Chinese hotels have taken a more measured approach, opting for simpler yet highly effective robotic solutions. Delivery robots are now commonplace in hotel chains across the country, and while not overly complex, they are adept at navigating hallways and lifts autonomously, bringing meals to guests.

By focusing on specific, high-impact problems, Chinese companies have successfully integrated AI in ways that minimise disruption and maximise usefulness.

The Chinese restaurant chain I mentioned earlier provides another good illustration of this approach. After the success of its chatbot, Haidilao introduced “smart restaurants” equipped with robotic arms and automated food delivery systems. While innovative, the technology struggled during peak hours and lacked the personal touch many customers valued.

Instead of abandoning the project, Haidilao continued to adjust and refine its use of AI. Rather than adopting a fully automated restaurant model, it went for a hybrid approach, combining automation with human staff to enhance the dining experience.

This flexibility in the face of setbacks represents a crucial willingness to pivot and adapt when things don’t go as planned. Overall, China’s pragmatic approach to AI has enabled it to take the lead in many areas, even as the country lags behind the west in terms of technological sophistication. This is driven by a willingness to embrace AI’s imperfections, and then adapt where necessary.

Where speed and adaptability are critical, companies can’t afford to wait for perfect solutions. By embracing AI’s imperfections, focusing on practical applications and real-world feedback, Chinese companies have unlocked the economic value of AI in a way that others are being too timid to emulate.

This article is republished from The Conversation under a Creative Commons license. Read the original article.