China

Putin and Xi: Beijing Belt and Road meeting highlighted Russia’s role as China’s junior partner

The recent Belt and Road Forum in Beijing saw decreased attendance from world leaders, highlighting geopolitical tensions. Vladimir Putin emphasized Sino-Russian cooperation, but trade imbalances reveal Russia’s subordinate role.

The third Belt and Road Forum held in Beijing recently attracted fewer heads of state or senior officials than the previous forums in 2017 and 2019. There were 11 European presidents and prime ministers at the 2019 forum. But last week’s forum attracted only three.

This is understandable, given that the two-day meeting took place against the backdrop of high tension in the Middle East caused by the conflict between Israel and Hamas as well as the war in Ukraine – both wars which have highlighted differences in views on regional and global order between the west and a number of non-western countries.

One enthusiastic participant was the Russian president, Vladimir Putin. For Putin, the forum provided an opportunity to meet other leaders without fear of arrest, given his indictment by the International Criminal Court for war crimes which had kept him away from September’s Brics summit in South Africa.

While Putin was just one among 20 or so world leaders at the Forum, he was photographed at Xi Jinping’s right hand and given a prominent place in proceedings. Delivering a speech at the forum immediately after the Chinese president and staging a press conference for the Russian media before boarding the plane to Moscow, Putin attempted to convey the message of tight cooperation with China.

He was keen to remind his audience of Russia’s credentials as a UN security council member, together with China, responsible for the maintenance of international peace and security. He also noted that he and Xi had discussed both the situation in Gaza and the events in Ukraine, describing these situations as “common threats” which strengthen Sino-Russian “interaction”.

Putin drew particular attention to the high bilateral trade volume between Russia and China, which has reached nearly US$200 billion (£163 billion). This sounds impressive until you remember that the bulk of this trade consists of export of Russian hydrocarbons and other raw materials to China. This is nothing new – in fact trade in hydrocarbons between Russia and China have been boosted by western sanctions.

Perhaps the most instructive aspect of the visit was Putin’s explicit acknowledgement of the different roles played by Moscow and Beijing in international politics. Putin described the Russia-dominated Greater Eurasian Partnership (GEP) – a concept Moscow has promoted as a response to the Belt and Road Initiative (BRI) that would fuse the Eurasian Economic Union with the BRI – as a regional or “local” project. Meanwhile he happily described the BRI as “global” in scale.

For the past decade, Russian policymakers and experts have consistently held up the GEP as symbolising Russia’s equality with China. Russian foreign minister Sergei Lavrov has described it as “the creation of a continent-wide architecture”.

Putin’s words, coupled with the lack of any meaningful results of the meeting (bar a contract on food and agricultural products which has yet to be confirmed by Beijing), illustrate the extent to which Russia’s war against Ukraine has deepened the asymmetry between the two powers.

Holding back?

The lack of genuine progress on the issue of the Power of Siberia-2 pipeline, which will transport gas from Russia’s Yamal gas fields, which used to supply Europe, via Mongolia to China, was further evidence of this asymmetry. Xi was kind enough to express hope that the project could proceed quickly. But he did not outline any concrete steps in that direction.

China’s agreement, if confirmed by a contract, would have been the most clear signal of Beijing’s strategic support for Russia, especially given Gazprom’s shrinking European market. By prolonging negotiations, China seems to be trying to extract specific concessions from Russia, related to the price of gas, possible Chinese ownership of gas fields in Russia, or Beijing’s acquisition of shares in Gazprom.

Meanwhile, in May 2023, China revived the prospect of building the so-called section “D”, enlarging the capacity of the Central Asia-China gas pipeline system, which will bring gas from Turkmenistan via Kyrgyzstan and Tajikistan to China, emphasising China’s other sources of energy supplies.

While continuing to offer Moscow political support and not interfering with Chinese companies’ attempts to take advantage of the exodus of western companies to increase their presence in the Russian market, Beijing has clearly attempted to prevent any embarrassment related to Russia. A gas contract would have overshadowed the BRI summit and generated a strong reaction in the US and Europe, potentially strengthening China hawks in the west.

Beijing making its move

Putin’s delegation was full of ministers and CEOs of key Russian enterprises, from Rosneft and Gazprom to Novatek, so the conclusion of commercial agreements can’t be ruled out, but the probability is low. It is clear that Beijing does not want to be seen to be openly supporting Russia in resisting and bypassing western sanctions.

In the 1990s, Russian officials regularly warned of the dangers of becoming a “raw materials appendage” to China. Today the economic benefits that Russian elites gain from hydrocarbons mean this danger has now become a reality. Russia has locked itself into an economic partnership in which it is the supplicant, a role that Moscow seems happy to play.

But the BRI is not just about economics. It is also a key part of Beijing’s bid to project itself as a “global responsible power”. Beijing has recently outlined what it calls its “Global Security Initiative” which explicitly rejects the Western rules-based order. This comes alongside a “Global Development Initiative” and, nested within these, a “Global Civilisation initiative”. Taken together these question western universalist ideas about human rights and democracy.

China’s thinking has gained traction among many countries of the global south, providing a developmental path without lectures on human rights. China speaks to these countries using its dual identity as both a rapidly developing power and a member of the UN security council. By comparison, notwithstanding its security council position, Russia has few tangible benefits to offer these countries. Last week’s BRI forum has driven this point home.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

China

Introducing Our 2025 Guide to Corporate Taxation and Compliance in China – Now Available!

Taxation significantly impacts businesses in China, making compliance crucial to avoid severe penalties and reputational harm. The “Guide to Corporate Taxation and Compliance in China 2025” offers insights on key taxes and trends, providing practical guidance for executives managing company finances.

Taxation affects almost all aspects of doing business in China. As businesses increasingly engage with this dynamic market, understanding and adhering to tax compliance is paramount. The implications of non-compliance can be severe, ranging from financial penalties to reputational damage, making it essential for companies to prioritize their tax obligations.

The Guide to Corporate Taxation and Compliance in China 2025, compiled by professionals at Dezan Shira & Associates in November 2024, introduces the major taxes that impact businesses in China, including corporate income tax, value-added tax, import-export taxes, and others. We also explore prominent and emerging trends that shape the corporate tax landscape, such as digitalization and global economic influences. Additionally, practical guidance will be offered to help businesses enhance their tax efficiency and ensure compliance.

This practical and easy-to-understand guidebook will be of invaluable use to all executives involved in handling company finances concerning China, including:

| This article was first published by China Briefing , which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in in China, Hong Kong, Vietnam, Singapore, and India . Readers may write to info@dezshira.com for more support. |

Read the rest of the original article.

China

Brics+ countries are determined to trade in their own currencies – but can it work?

Brics+ countries aim to increase local currency trade to reduce dependence on major currencies like the US dollar, lowering transaction costs and fostering economic growth while addressing financial sanctions challenges.

Brics+ countries are exploring how they can foster greater use of local currencies in their trade, instead of relying on a handful of major currencies, primarily the US dollar and the euro.

The forum for cooperation among nine leading emerging economies – Brazil, China, Egypt, Ethiopia, India, Iran, Russian Federation, South Africa, United Arab Emirates – emphasised this determination at their 16th summit in October 2024.

Economist Lauren Johnston recently wrote a paper on this development. The Conversation Africa asked her for her insights.

Why do Brics+ countries want to trade in local currencies?

There are economic and political reasons to use local currencies.

Using local currencies to trade among themselves will lower the transaction costs and reduce these countries’ dependence on foreign currencies.

Over the past few centuries, the world’s economy has developed in a way that makes certain currencies more valuable and widely trusted for international trade. These include the US dollar, the euro, the Japanese yen and the British pound. These currencies hold value around the world because they come from countries with strong economies and a long history of trading globally.

When people or countries trade using these currencies and end up collecting or holding them, they consider it “safe” because the value of these currencies remains stable and they can be easily used or exchanged anywhere in the world.

But for countries in the global south, like Ethiopia, whose currency (the birr) isn’t widely accepted outside its borders, trading is far more difficult. Yet these countries struggle to earn enough of the major currencies through exports to buy what they need on international markets and to repay their debts (which tend to be in those currencies). In turn, the necessity of trading in major currencies, or the inability to trade in them, can create challenges that slow down economic growth and development.

Therefore, even some trade in local currencies between Brics+ members will support growth and development.

Oil exporter Russia is a unique case. Though there are fewer foreign currency constraints overall, Russia faces extensive financial sanctions for its war of aggression against Ukraine. Using a variety of currencies in its foreign transactions may make it easier to get around these sanctions.

Politically, the reasons for using other currencies primarily relates to freedom from sanctions.

One of the tools for making sanctions work is an international payments systems known as Swift (Society for Worldwide Interbank Financial Telecommunication). Swift was founded in 1973 and is based in Belgium. It enables secure and standardised communication between financial institutions for international payments and transactions. And it’s almost the only way to do this.

It was first used to impose financial sanctions on Iran in 2012, and has since been used to impose sanctions on Russia and North Korea.

If a country is cut off from Swift, it faces disruptions in international trade and financial transactions, as banks struggle to process payments. This can lead to economic isolation and challenges in accessing global markets.

The reality, and possibility, of exclusion from Swift’s payments system is one of the factors galvanising momentum towards a new payments system that also relies less on the currencies of the countries that govern Swift – like the euro, Japanese yen, British pound and US dollar.

What are the likely challenges they will face?

The Brics+ plan to use local currencies faces some hurdles.

The central problem is the lack of demand for most currencies internationally. And it’s hard to supplant the international role of existing major currencies.

If, for example, India accumulates Ethiopian birr, it can mainly only use them in trade with Ethiopia, and nowhere else. Or, if Russia allows India to buy oil in rupees, what will it do with those rupees?

Since most countries seeking alternatives to dollar dependence tend to sell more than they buy from other countries, or are lower-income importers, they must consider what currencies to accumulate via trade.

When it comes to payment systems, at least, alternatives are emerging.

Brics+ is creating its own, Brics+ Clear. Some 160 countries have signed up to using the system. China also has its own, Cross-border Inter-bank Payment System, which broadly works the same way as Swift.

There’s a risk, though, that these payment methods could merely fragment the system and make it even more costly and less efficient.

Has trading in local currencies been done elsewhere?

Not all trade is done in major western currencies.

For example, in southern Africa, within the Southern African Customs Union, the South African rand plays a relatively important role in cross-border trade and finance. Just as in south-east Asia the currencies of Singapore and Thailand compete to be the dominant currency in the sub-region.

China – the world’s biggest exporter and producer of industrialised goods – is also signing bilateral currency swap agreements with countries. The goal is greater use of the renminbi in the world.

As a means of circumventing sanctions, India and Russia recently trialled using the rupee to trade. Russia’s oil exports to and through India have risen strongly since the Ukraine war and some 90% of that bilateral trade takes place in the rupee and rouble. This leaves Russia with a challenge – what to do with all the rupees it has accumulated. These deposits are sitting in Indian banks and being invested in local shares and other assets.

Another example of efforts to side-step major international currencies is China’s model of “barter trade”. The model works like this: China exports, for instance, agricultural machinery to an African country and receives payment in that country’s currency. China then uses that currency to buy goods from the same country, which are then imported back to China. After these goods are sold in China, the Chinese trader is paid in renminbi.

Ghana is one country involved in this barter model. Challenges facing the model include the digitisation of payments and trade, and trust – high levels are needed to establish and maintain relationships between trading parties as individuals and as businesses. It also requires some level of centralisation and coordination, but lacks strong laws, regulations and industry standards. This means that different platforms and enterprises may not be compatible, which can add to transaction time and costs.

Another example is when Chinese investors in Ethiopia make profits in birr. They use these birr to buy Ethiopian goods, like coffee, and export the goods to China. In China, when they sell these goods, they receive renminbi. So they transfer their profits from Ethiopia to China by increasing Ethiopia’s exports to China.

Anecdotal reports suggest this is feasible at a small scale but has relatively high coordination costs.

There could be other challenges. For example, if Chinese buyers pay Ethiopian coffee farmers in their local currency, instead of US dollars, it could lead to fewer dollars being available overall. Some international transactions still rely heavily on dollars.

How should Brics+ nations structure their arrangement?

There is no simple, or easily scalable, solution to moving past the reliance on major international currencies or circumventing Swift.

A fast, digital payment system is needed. This system would calculate and balance currency demand efficiently. It must also be reliable, replace parts of the current system, and not create extra costs for countries that aren’t using it yet.

Although some Brics+ members, like Russia, may have more interest in fast-tracking change, this may be less in the interest of other Brics+ members. A move away from Swift, for instance, requires buy-in from local financial institutions, and those in African countries may not be under pressure to shift to a new lesser-known platform.

Given these challenges, I argue that Brics+ should progress incrementally. What can happen soon, though, is to conduct some trade in local currency.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Business

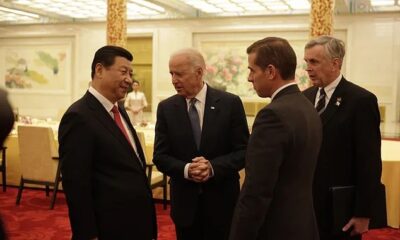

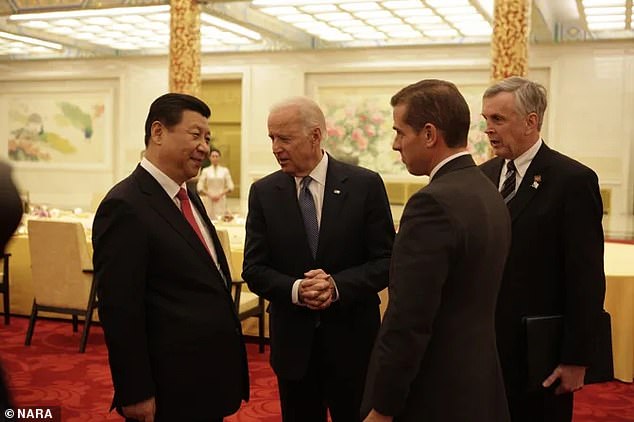

Previously Unseen Photos of Joe and Hunter Biden in China Spark New Questions About Son’s Business Ventures for the President

Unseen photos of Joe and Hunter Biden with Chinese leaders have intensified scrutiny on Hunter. Joe recently pardoned Hunter for past gun and tax fraud charges, igniting controversy over their business dealings.

New Photos Stir Controversy

Previously unseen photographs of Joe and Hunter Biden meeting with Chinese President Xi Jinping, along with Hunter’s business associates, have reignited scrutiny around the First Son. This visual evidence coincides with ongoing controversies surrounding Hunter’s business dealings following President Biden’s recent blanket pardon for his son on gun and tax fraud charges dating back to 2013.

Business Connections Revealed

The snapshots, sourced from the National Archives, depict Joe Biden engaging in discussions during his vice presidency, including introducing Hunter to prominent figures like then-vice president Li Yuanchao and business executives from BHR Partners. Hunter Biden, who co-founded the private equity firm BHR, has faced criticism concerning his financial ties to Chinese companies.

Biden’s Defense and Future Implications

In light of these revelations, the President has reiterated that he never engaged in business discussions with Hunter. However, the photos have fueled allegations previously brought forth during impeachment inquiries, prompting mixed reactions from political opponents and supporters. Hunter’s recent pardon, which extends to potential future charges, raises questions about the implications for his past dealings.