China

Why China is seeking greater presence in Africa – the strategy behind its financial deals

China plans to deepen its relationship with Africa, pledging $51 billion in loans and investments, aiming for increased diplomatic ties, economic growth, and expanded influence amidst Western concerns about debt-trap diplomacy.

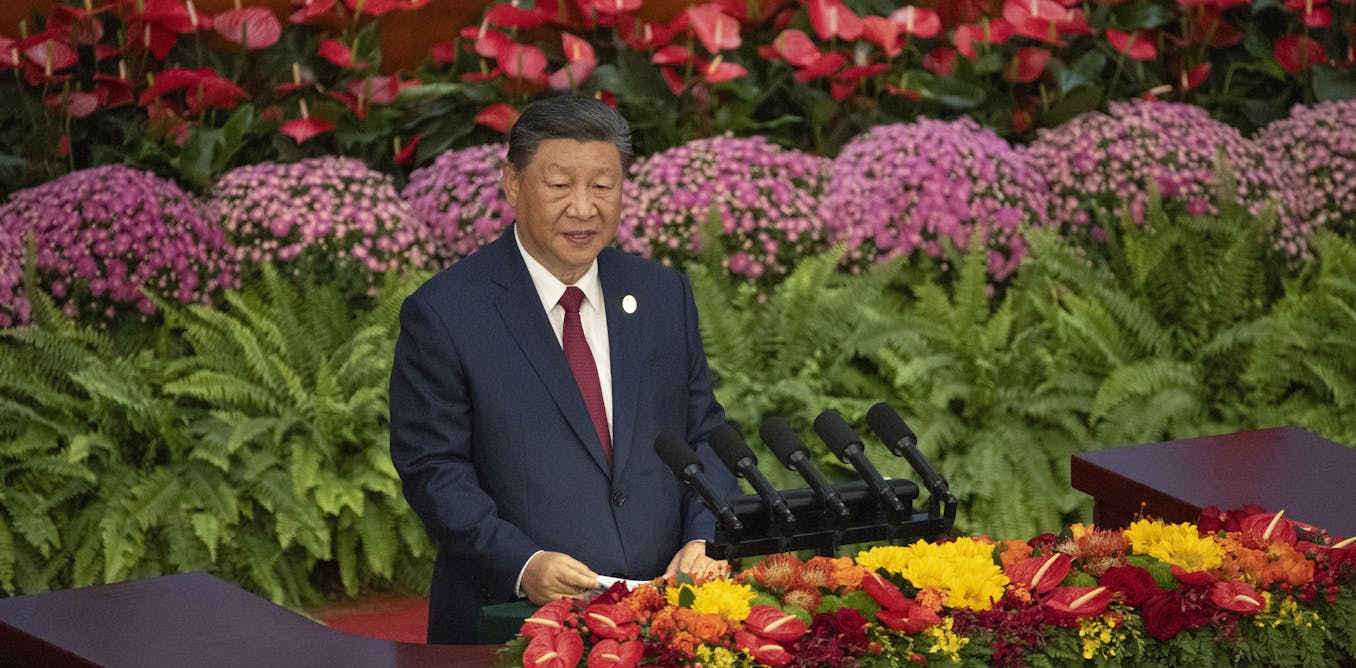

China’s relationship with Africa is set to deepen. At a summit in Beijing in early September, China’s president, Xi Jinping, pledged to deliver US$51 billion (£39 billion) in loans, investment and aid to the continent over the next three years, as well as upgrading diplomatic ties.

Beijing’s close engagement with Africa is not new. Since 1950, the first overseas trip of the year for Chinese foreign ministers has almost always been to one or more African countries. But Xi’s commitments are still sure to raise concerns in the US and other western countries, which are competing with China for global influence.

They may well also bring back fears of China using “debt-trap diplomacy” to push African countries into default and thereby gain leverage over them. Such is the strength of this narrative that South Africa’s president, Cyril Ramaphosa, felt compelled to deny it at the summit.

The notion of Chinese debt traps, particularly the infamous case of Sri Lanka’s port of Hambantota that, in 2017, was leased by the Sri Lankan government to a Chinese company to raise liquidity, has been debunked several times.

But with African populations and economies growing, and China’s engagement with them continuing to deepen, it is important to understand what China hopes to achieve with its diplomacy.

China’s engagement with Africa is strategic as well as economic. Whether it’s gaining votes at the UN, better access to resources, or increasing the international use of its currency, China’s diplomatic relations with Africa play into its ambitions of being a major player in a multipolar world.

Chinese children hold national flags as they prepare for the arrival of Togo’s president, Faure Gnassingbe, at Beijing International Airport ahead of the summit.

Ken Ishii / Pool / EPA

The long game

From a purely economic perspective, Africa is a potentially lucrative market for China. With its under-served market and booming population, the scope for expansion into Africa offers huge potential for Chinese firms.

This is particularly true now that the African Continental Free Trade Area (which was established in 2018) opens up the possibility of cross-border value chains developing in Africa.

Most of the goods that China imports from Africa are natural resources. Many of these resources have strategic relevance, for example, in manufacturing batteries. In return, Chinese companies export a wide range of goods to Africa, including manufactured products, industrial and agricultural machinery, and vehicles.

In terms of foreign direct investment, Chinese companies are still only the fifth-largest investors in Africa after their Dutch, French, US and UK counterparts. But their ascent has been relatively quick, and while western companies are focused on resources and the financial sector, Chinese ones also invest heavily in construction and manufacturing.

Chinese companies are major players in Africa’s construction sector, often working on projects funded by loans from Chinese banks to African governments. In 2019, for example, Chinese contractors accounted for about 60% of the total value of construction work in Africa.

Some of the infrastructure financed by China has done little to improve trade or economic development in Africa. And it has, admittedly, also contributed to the increased debt burden of several African countries.

The costly expressways that connect Nairobi in Kenya and Kampala in Uganda to the respective international airports, for instance, have made life easier for city elites and international travellers. But they have not led to economic growth.

So, China has moved to recalibrate its infrastructure finance in recent years. In 2021, Xi introduced the concept of “small and beautiful” projects better targeted at the partner country’s needs – a concept he repeated at the recent summit.

It is this alignment with the requests of African leaders that differentiates China’s engagement with Africa from that of the west. A key request of many African leaders is for investment in manufacturing value chains and imports of African processed goods rather than just raw resources.

Xi’s keynote speech addressed these two concerns. He promised more investment in key sectors and to allow more African goods to enter China without duties.

The construction of the Nairobi Expressway was supposed to decongest Kenya’s capital city, Nairobi.

Daniel Irungu / EPA

China’s support to African nations is political as well as economic. Its policy of non-interference in Africa’s internal affairs have been well received by African leaders – a sharp contrast to western nations who have often tied their support to the respect of certain social or economic conditions.

This has, in turn, bolstered China’s diplomatic influence on the continent. A good indicator of this influence is how many countries maintain diplomatic relations with Taiwan, which the Chinese government sees as part of China’s territory. In Africa, only Eswatini has full relations with Taiwan and just a handful of other countries have representative offices.

Another Chinese goal is to expand the global reach of its currency, the renminbi. Its motive here is to challenge the dominance of the US dollar, which gives America control over transactions anywhere in the world.

Since the late 2000s, the People’s Bank of China has signed bilateral swap agreements with Morocco, Egypt, Nigeria and South Africa to conduct transactions in renminbi. And China is aiming to increase the use of renminbi in official lending, both through domestic banks such as the China Development Bank and regional institutions such as the New Development Bank.

Much like Africa’s western partners, China pursues both political and economic interests in its dealings with the continent. But, with western leaders paying little attention to Africa, China doesn’t need to pursue debt-trap diplomacy to increase its influence there. It just needs to put forward a better partnership offer to gain ground.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Business

Democrat Claims Musk is Undermining Spending Bill Due to China Restrictions – The Hill

A Democrat claims Elon Musk influenced the reduction of a spending bill due to its restrictions on China, suggesting his actions impacted the legislation’s progress and funding allocation.

Allegations Against Musk

A prominent Democrat has accused Elon Musk of deliberately sabotaging a significant spending bill in response to China-related restrictions. This accusation comes amid ongoing tensions between the U.S. and China, particularly regarding technology and trade policies. The claims suggest that Musk’s influence is affecting critical legislative processes, raising concerns among lawmakers about foreign influence in American politics.

Implications for Legislation

The potential ramifications of Musk’s alleged actions could be significant. As a major player in the tech industry, his decisions can sway public opinion and impact the economy. Lawmakers fear that if influential figures like Musk oppose necessary legislation, it might hinder efforts to address vital issues such as national security and economic stability.

Political Reactions

The controversy has sparked debates among both Democrats and Republicans, highlighting the intersection of technology and politics. Many are demanding greater transparency and accountability from tech giants. As the situation unfolds, lawmakers may need to reassess their strategies to ensure that essential legislation moves forward uninterrupted.

Source : Democrat accuses Musk of tanking spending bill over China restrictions – The Hill

China

Dissolving a Company in China: A Comparison of General Deregistration and Simplified Deregistration

China promotes simplified deregistration to enhance its business environment, offering a faster process requiring fewer documents than general deregistration. Companies must meet eligibility criteria, resolve issues, and can choose procedures based on their situation, ensuring compliance for both options.

In addition to the general deregistration procedures, China has been promoting simplified deregistration as one of the key measures to enhance its business environment. This article highlights the differences between the general and simplified procedures, explains the eligibility criteria, and clarifies common misunderstandings about these processes.

Foreign investors may decide to close their business for multiple reasons. To legally wind up a business, investors must complete a series of procedures involving multiple government agencies, such as market regulatory bureaus, foreign exchange administrations, customs, tax authorities, banking regulators, and others. In this article, we outline the company deregistration process overseen by the local Administration for Market Regulation (AMR), comparing the general and simplified procedures.

Before 2016, companies could only deregister through the general procedure. However, on December 26, 2016, the Guidance on Fully Promoting the Reform of Simplified Company Deregistration Procedures was released. Effective March 1, 2017, simplified deregistration procedures were implemented nationwide. Since then, there have been two options: general procedures and simplified procedures.

Companies must follow the general deregistration process if any of the following conditions apply (hereinafter referred to as “existing issues”):

Companies not facing the above issues may choose either the general or simplified deregistration process.

In summary, simplified deregistration is a faster process and requires fewer documents compared to general deregistration. Companies that meet the criteria typically would typically opt for simplified deregistration. Those that do not meet the criteria may choose this route after resolving outstanding issues. For companies with unresolved issues but seeking urgent closure, they can first publish a deregistration announcement. Once the announcement period ends and all issues are addressed, they can proceed with general deregistration. Some companies may question the legitimacy and compliance of simplified deregistration. This is a misconception. “Simplified” does not mean non-compliant, just as “general” does not imply greater legitimacy. Both processes are lawful and compliant. The AMR provides these options to enable companies ready for closure to complete the process efficiently while granting those with unsolved issues the necessary time to address them after publishing the deregistration announcement. Companies can select the most suitable process based on their specific circumstances.

| This article was first published by China Briefing , which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in in China, Hong Kong, Vietnam, Singapore, and India . Readers may write to info@dezshira.com for more support. |

Read the rest of the original article.

China

China’s influence grows at COP29 climate talks as US leadership fades

The 2024 U.N. climate talks in Baku yielded mixed results, agreeing to increase funding for developing nations. However, challenges remained in addressing greenhouse gas emissions and achieving sustainable progress.

The 2024 U.N. climate talks ended in Baku, Azerbaijan, on Nov. 24 after two weeks of arguments, agreements and side deals involving 106 heads of states and over 50,000 business leaders, activists and government representatives of almost every country.

Few say the conference was a resounding success. But neither was it a failure.

The central task of the conference, known as COP29, was to come up with funding to help developing countries become more resilient to the effects of climate change and to transition to more sustainable economic growth.

The biggest challenge was agreeing on who should pay, and the results say a lot about the shifting international dynamics and offer some insight into China’s role. As a political science professor who has worked on clean tech policy involving Asia, I followed the talks with interest.

Slow global progress

Over three decades of global climate talks, the world’s countries have agreed to cut their emissions, phase out fossil fuels, end inefficient fossil-fuel subsidies and stop deforestation, among many other landmark deals.

They have acknowledged since the Rio Earth Summit in 1992, when they agreed to the U.N. Framework Convention on Climate Change, that greenhouse gas emissions produced by human activities, including the burning of fossil fuels, would harm the climate and ecosystems, and that the governments of the world must work together to solve the crisis.

But progress has been slow.

Greenhouse gas emissions were at record highs in 2024. Governments are still subsidizing fossil fuels, encouraging their use. And the world is failing to keep warming under 1.5 degrees Celsius compared with preindustrial times – a target established under the 2015 Paris Agreement to avoid the worst effects of climate change.

Extreme weather, from lethal heat waves to devastating tropical cyclones and floods, has become more intense as temperatures have risen. And the poorest countries have faced some of the worst damage from climate change, while doing the least cause it.

Money for the poorest countries

Developing countries argue that they need US$1.3 trillion a year in financial support and investment by 2035 from the wealthiest nations – historically the largest greenhouse gas emitters – to adapt to climate change and develop sustainably as they grow.

That matters to countries everywhere because how these fast-growing populations build out energy systems and transportation in the coming decades will affect the future for the entire planet.

Negotiators at the COP29 climate talks. Less developed countries were unhappy with the outcome.

Kiara Worth/UN Climate Change via Flickr

At the Baku conference, member nations agreed to triple their existing pledge of $100 billion a year to at least $300 billion a year by 2035 to help developing countries. But that was far short of what economists have estimated those countries will need to develop clean energy economies.

The money can also come from a variety of sources. Developing countries wanted grants, rather than loans that would increase what for many is already crushing debt. Under the new agreement, countries can count funding that comes from private investments and loans from the World Bank and other development banks, as well as public funds.

Groups have proposed raising some of those funds with additional taxes on international shipping and aviation. A U.N. study projects that if levies were set somewhere between $150 and $300 for each ton of carbon pollution, the fund could generate as much as $127 billion per year. Other proposals have included taxing fossil fuels, cryptocurrencies and plastics, which all contribute to climate change, as well as financial transactions and carbon trading.

China’s expanding role

How much of a leadership role China takes in global climate efforts is an important question going forward, particularly with U.S. President-elect Donald Trump expected to throttle back U.S. support for climate policies and international funding.

China is now the world’s largest emitter of greenhouse gases and the second-largest economy.

China also stands to gain as provider of the market majority of green technologies, including solar panels, wind turbines, batteries and electric vehicles.

Whether or not China should be expected to contribute funding at a level comparable to the other major emitters was so hotly contested at COP29 that it almost shut down the entire conference.

Previously, only those countries listed by the U.N. as “developed countries” – a list that doesn’t include China – were expected to provide funds. The COP29 agreement expands that by calling on “all actors to work together to enable the scaling up of financing.”

In the end, a compromise was reached. The final agreement “encourages developing countries to make contributions on a voluntary basis,” excluding China from the heavier expectations placed on richer nations.

Side deals offer signs of progress

In a conference fraught with deep division and threatened with collapse, some bright spots of climate progress emerged from the side events.

In one declaration, 25 nations plus the European Union agreed to no new coal power developments. There were also agreements on ocean protection and deforestation. Other declarations marked efforts to reenergize hydrogen energy production and expanded ambitious plans to reduce methane emissions.

Future of UN climate talks

However, after two weeks of bickering and a final resolution that doesn’t go far enough, the U.N. climate talks process itself is in question.

In a letter on Nov. 15, 2024, former U.N. Secretary-General Ban Ki-moon and a group of global climate leaders called for “a fundamental overhaul to the COP” and a “shift from negotiation to implementation.”

After back-to-back climate conferences hosted by oil-producing states, where fossil-fuel companies used the gathering to make deals for more fossil fuels on the side, the letter also calls for strict eligibility requirements for conference hosts “to exclude countries who do not support the phase out/transition away from fossil energy.”

With Trump promising to again withdraw the U.S. from the Paris Agreement, it is possible the climate leadership will fall to China, which may bring a new style of climate solutions to the table.

This article is republished from The Conversation under a Creative Commons license. Read the original article.