China

Indonesia president’s diplomatic dash takes in China and US − but a Trump presidency may see the aspiring regional powerhouse tilt more toward Beijing

Indonesian President Prabowo Subianto is balancing relations with China and the U.S., pursuing regional stability and leadership while hinting at a shift towards closer ties with Beijing amid a potential Trump administration.

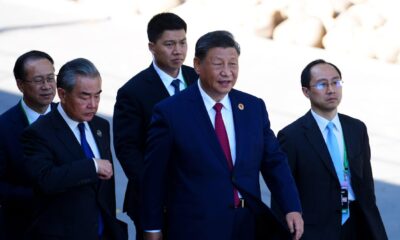

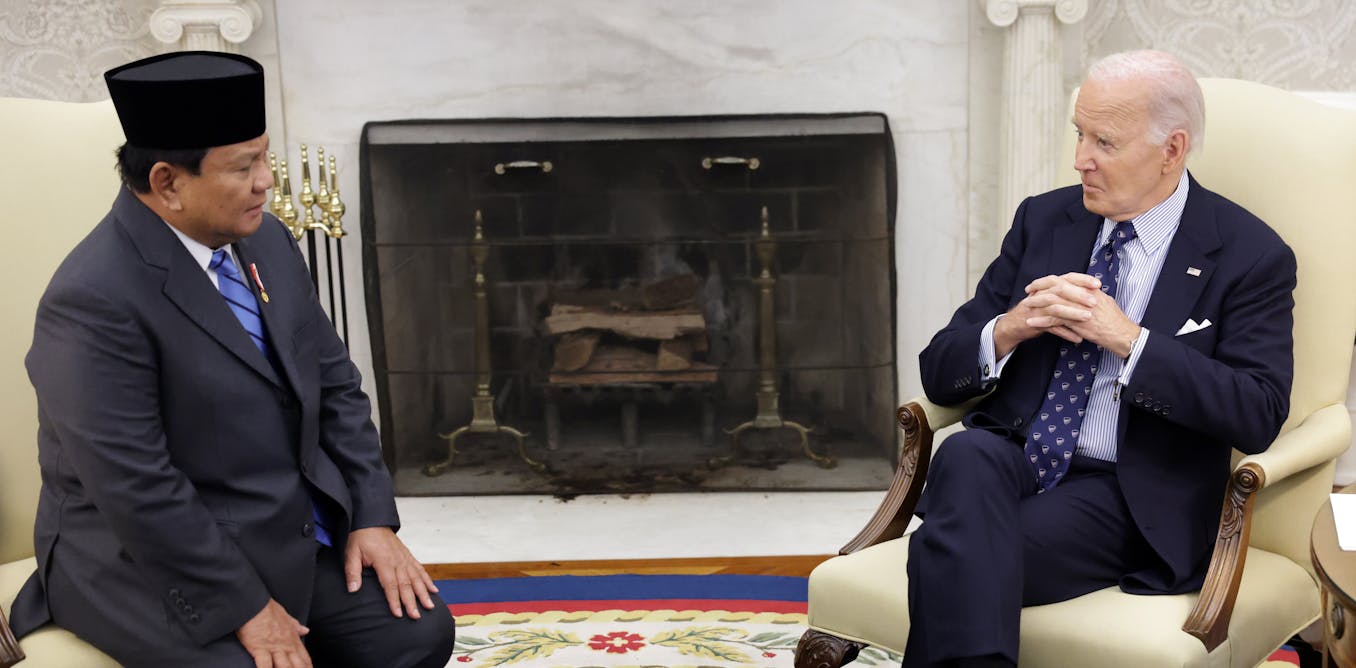

It’s been a whirlwind week for Indonesian president Prabowo Subianto. On Nov. 9, he was breaking bread with Chinese leader Xi Jinping; three days later he was sitting down with President Joe Biden in the White House. In between, Subianto found time to reach out to Donald Trump to congratulate the incoming U.S. president on his election victory.

The visits to the U.S. and China form part of a two-week overseas tour for Subianto that will also take him to Peru, Brazil and the U.K., as well as several Middle East countries.

The itinerary hints at the diplomatic priorities of the newly seated president of Southeast Asia’s biggest economy: balancing Indonesia’s relations with key members of both the West and the Global South, while seeking a more assertive leadership role in Southeast Asia.

Indonesia’s balancing act

Subianto’s back-to-back meetings with Xi and Biden highlight the role Indonesia tries to play in ensuring regional stability and security in the Indo-Pacific.

The meetings coincided with an ongoing U.S.-Indonesian marine exercise off the Indonesian island of Batam. The third annual military exercise of its kind, such maneuvers between U.S. and Southeast Asian partners have tended in the past to be framed as a countermeasure to China’s assertiveness in the contested waters of the South China Sea. But while U.S. and Indonesian marines were engaged in drills, Subianto and Xi were making nice – pledging greater maritime cooperation between the two countries.

The big question now is how a Trump White House will affect Indonesia’s balancing act on security in the Indo-Pacific region.

Trump’s Indo-Pacific strategy

Trump’s first presidency offers some clues into what his second term may look like regarding its Indo-Pacific policy. The 2019 Indo-Pacific Strategy Report issued by the Trump administration marked China as a “revisionist” power – that is, one that is dissatisfied with the current status quo – and an aspiring regional hegemon.

To counter this, Trump adopted an “offshore balancing” strategy – in effect utilizing regional allies to keep China in check. This approach involved security pacts with traditional allies and joint military training exercises with countries such as the Philippines and Indonesia. It also included providing military equipment to partners in the region and occasional U.S. Navy “freedom of navigation” operations.

China’s nine-dash line takes in territory claimed by other nations..

AP Photo/Andy Wong

But there was another side to Trump’s Indo-Pacific strategy. Aware of the U.S.’s lack of direct security interests in the region – no U.S. territories are threatened – but concerned that any escalation could lead to military conflict, Trump was willing to back down on potential flash points with China in the South China Sea in exchange for Beijing’s cooperation in confronting one of the region’s key threats to stability: North Korea.

These two policy tweaks under Trump’s first administration – easing pressure on Beijing in the South China Sea while outsourcing regional stability to Washington’s Indo-Pacific allies – handed to Indonesia a challenge and opportunity.

As Southeast Asia’s largest and most populous nation, Indonesia was required to show leadership in the negotiation of the code of conduct in the South China Sea as part of its key diplomatic mission to maintain regional stability.

Subianto tilts toward China

Indonesia has long been willing to shoulder the burden of managing regional security. Successive leaders have taken the role seriously, especially given the country’s constitutional mandate to pursue an “independent and active” foreign policy. Historically, this has meant Indonesian leaders avoiding being too close to either the U.S. or China in order to boost their credibility as an independent actor.

Chinese President Xi Jinping, right, shakes hands with Indonesian President Prabowo Subianto.

Xie Huanchi/Xinhua via Getty Images

But since Subianto was inaugurated as the president of Indonesia in October 2024, Indonesia’s foreign policy has shown a nascent shift away from the West. Days after his inauguration, Subianto sent his new foreign minister to Kazan, Russia, to attend the meeting of BRICS nations and express Indonesia’s desire to join the expanding bloc of non-Western economies.

BRICS’s largest member is China, and the group seeks to position itself as an alternative to Western security and financial architecture.

This formal expression of intent to join BRICS marks a change from policy under Subianto’s predecessor, Joko Widodo.

Furthermore, a joint statement issued during Subianto’s visit to Beijing suggests that Indonesia is starting to entertain Beijing historical maritime claims in the South China Sea.

For decades, Indonesia refused to acknowledge Beijing’s claims on rocks and atolls within Indonesia’s exclusive economic zone in the waters around Natuna – an Indonesian island that intersects with China’s “nine-dash line” denoting the area Beijing sees as Chinese.

But the joint statement issued during Subianto’s visit to Beijing stated that the two countries had reached “an important common understanding on joint development in areas of overlapping claims” that was consistent with “respective prevailing laws and regulations.”

Talk of “overlapping claims” is a departure for Indonesia and suggests that Subianto is willing to move closer to accepting the boundaries set by Beijing in the South China Sea.

OECD or BRICS? Or both?

This isn’t to say that Indonesia is cutting off its options for greater cooperation with the West, too. During the White House leg of Subianto’s visit, Biden signaled the U.S.’s strong support for Indonesia’s push to join the Western-dominated Organization for Economic Cooperation and Development.

OECD membership would serves as a benchmarking platform for Indonesia, with the organization setting international standards and support for Indonesia to help attract better quality foreign investment.

BRICS membership, meanwhile, would represent more of a political and economic move that would place Indonesia alongside other countries seeking an alternative to the U.S.-dominated international institutions.

The impetus for Indonesia to join could only deepen should Trump’s plan to slap heavy tariffs on overseas goods come to fruition.

Providing cover for Subianto

Certainly, it appears that Indonesia under Subianto could develop a more pro-Beijing stance in the face of a Trump White House.

Wars in Ukraine and the Middle East are likely to take up much of Trump’s immediate attention, pushing issues such as security in Southeast Asia – and more generally in the Indo-Pacific region – further down the list.

Meanwhile, the Chinese government shows no signs of deviating from a policy that includes incremental moves to control the South China Sea and exert its economic influence on nations in Southeast Asia.

Already, some observers are questioning whether Indonesia’s shift in how disputed territory in the South China Sea is discussed is tied to economic cooperation with China that includes the US$10 billion worth of deals signed during Subianto’s Beijing visit.

And a more insular, anti-interventionalist White House under Trump could give Subianto cover to forge Indonesia’s path as a regional leader, encouraging it to do so while also developing closer economic and strategic ties to China and the Global South.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Business

China Considers Selling TikTok US Operations to Musk as a Viable Option – Bloomberg

China is considering the sale of TikTok’s U.S. operations to Elon Musk as a potential option, according to a report by Bloomberg.

Potential Sale of TikTok to Elon Musk

Reports suggest that China is considering the sale of TikTok’s U.S. operations to Elon Musk as a viable option. This development follows ongoing scrutiny over the app’s data privacy practices and its links to the Chinese government. Officials believe that a sale could alleviate international concerns and preserve the platform’s presence in the U.S. market.

Strategic Implications

The potential transaction raises numerous strategic implications, not only for TikTok but also for Musk’s other ventures. If Musk were to acquire TikTok, it could enhance his digital footprint and provide new avenues for advertising and user engagement. Conversely, it could pose challenges in managing regulatory compliance and addressing data security issues.

Regulatory Hurdles Ahead

Despite the intriguing prospect of a sale, significant regulatory hurdles remain. Any acquisition would require approval from U.S. authorities, who continue to assess the risks associated with foreign ownership of tech companies. The outcome of these discussions could have widespread ramifications for both TikTok and the broader social media landscape.

Source : China Weighs Sale of TikTok US to Musk as a Possible Option – Bloomberg

China

Essential Insights into NGO Accounting and Compliance in China

China will implement an updated accounting system for non-profit organizations starting January 1, 2026, to standardize financial reporting and enhance management practices. The changes address evolving challenges in the NGO sector, ensuring regulatory compliance and effective donor fund management.

China has recently amended its accounting system for non-governmental non-profit organizations, with the new provisions set to take effect on January 1, 2026. As the number of NGOs continues to grow in the country, understanding the existing and updated requirements is crucial for organizations seeking to maintain regulatory compliance and effectively manage donor funds.

On December 20, 2024, the Ministry of Finance (MOF) unveiled the updated Accounting System for Non-governmental Non-profit Organizations (hereinafter, the “NGO Accounting System”), set to take effect on January 1, 2026.

Among others, the revision of the NGO Accounting System is designed to standardize financial reporting, enhance management practices, and provide a regulatory framework to support the high-quality development of non-governmental organizations (NGOs). As the sector expands and diversifies, new challenges have arisen, such as increasingly varied donation methods, rising foreign investments, and the growing number of NGOs being established. In response to these developments, the updated system aims to address emerging accounting issues and reflect the evolving nature of the sector.

In this article, we provide an overview of the current accounting and compliance landscape for NGOs in China, explore the key provisions of the new NGO Accounting System, and highlight the significant changes introduced in the revision.

In China, NGOs encompass a wide range of organizations, including social service agencies, foundations, nonprofit schools, medical institutions, religious organizations (e.g., Taoist temples, mosques, churches), and various other social service providers. Much like their counterparts globally, NGOs play a crucial role in addressing social, environmental, and economic challenges. These entities, typically nonprofit, are dedicated to causes such as education, healthcare, environmental protection, and humanitarian aid.

China’s legal framework for NGOs is multifaceted, governed by several key laws and regulations:

Accounting for NGOs requires meticulous tracking of funds and compliance with specific regulations and reporting standards to ensure transparency and accountability to donors, stakeholders, and the public. Unlike the Accounting System for Business Enterprises (ASBE, commonly referred to as CAS), the Accounting System for NGOs imposes unique requirements for handling various types of donations, including asset and labor donations, as well as the management of entrusted agency business, where the NGO acts as an intermediary to transfer assets to a designated beneficiary. The system also differentiates between restricted and unrestricted net assets, outlines specific classifications for the costs associated with business activities, and includes additional disclosure requirements in the financial notes. As more NGOs establish a presence in China, these standards have gained increased attention in recent years.

| This article was first published by China Briefing , which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in in China, Hong Kong, Vietnam, Singapore, and India . Readers may write to info@dezshira.com for more support. |

Read the rest of the original article.

China

The year ahead in the Middle East: A weakened Iran has big implications for China

Iran’s influence in the Middle East has significantly diminished post-Hamas’s Oct. 7 attack on Israel, impacting its alliances and prompting China to reconsider its relationship with Iran and strengthen ties with other regional powers.

The wheels of history have been turning rapidly in the Middle East over the last year.

For a significant period of time, Iran’s status as a rising power within the region has been regarded as a consistent reality in assessing Middle Eastern geopolitics. But events since the Oct. 7, 2023 attack by Hamas on Israel have seen Iran’s position in the region erode substantially. The balance of power in the Middle East has consequently been irreversibly altered.

A key pillar supporting Iran’s previously powerful status in the Middle East has been its cultivation of the “Axis of Resistance,” a group of Iranian allies across the region that acted together against Israeli and American interests.

The members of the axis, in addition to Iran itself, include Hamas, Hezbollah, Iraqi Shiite militias, the Houthis and Bashar al-Assad’s regime in Syria.

Read more:

Assad’s fall in Syria will further weaken Hezbollah and curtails Tehran’s ‘Iranization’ of region

Axis decimation

Israel’s relentless war in retaliation for the Oct. 7 attack has seen several of the most important members of the axis severely diminished, if not entirely decimated.

Both Hezbollah and Hamas have been humiliated through the destruction of their respective leaderships, and their operational capacities have been reduced significantly.

The largest blow to Iran’s proxy network was arguably the recent ousting of Syria’s Assad, ending a decades-long regime that was regarded by top Iranian strategists as Iran’s most important regional ally.

Syrians celebrate during a demonstration following the first Friday prayers since Bashar al-Assad’s ouster in Damascus’s central square on Dec. 13, 2024.

(AP Photo/Hussein Malla)

The adverse consequences of these developments for Iran’s grand strategy raises questions of how a significantly weakened Iran will affect the world at large, especially in terms of its impact on great power politics in the Middle East.

This undoubtedly represents a welcome development in the United States given the long-standing animosity towards post-1979 Iran among the American foreign policy establishment. But China is likely to have a more nuanced outlook predicated upon its commitment to pragmatic foreign policy maneuvering in accomplishing its top global objectives.

China’s engagement with Iran

As China has grown richer and more powerful in recent decades, it’s turned its attention to increasing its diplomatic clout and economic presence throughout the world. Every region of the planet has been affected by this development, but the Middle East achieved a spot of particular importance for China.

The Chinese government’s motivation to deeply engage in the Middle East has been — and continues to be — driven by several key considerations: the Middle East’s status as a powerhouse of oil production, its strategic geographic location bridging east and west, and its status as a long-standing pillar of American foreign policy.

China has fostered bilateral partnerships across the entire Middle East, but one of its longest regional relationships has been with Iran. In Iran, Chinese authorities saw a country that provided it with an opportunity to help it achieve China’s main objectives in the region.

Liu Zhenmin, China climate envoy, left, and Saudi Arabia Energy Minister Prince Abdulaziz Bin Salman, right, arrive for a plenary session at the COP29 UN Climate Summit in November in Baku, Azerbaijan.

(AP Photo/Rafiq Maqbool)

Post-1979, Iran was inherently anti-American, which meant that China was more likely to be warmly received by Tehran, especially when compared to other regional powers like Saudi Arabia that had relatively warm relations with the U.S.

Perhaps most importantly, Iran could be depended on — to an extent — to stymie American interests in the Middle East given its status as a rising regional power.

This is not to say that Iran became a Chinese client state, but rather that China could provide diplomatic and economic support to Iran as the Iranians used their power to act disruptively in a region of great strategic importance to the U.S.

China’s future moves

Given the motivations underlying deep Chinese-Iranian ties historically, it’s clear that the evaporation of Iran’s clout will likely greatly alter the character of their relationship moving forward.

In a nutshell, a significant portion of Iran’s appeal to Chinese policymakers has disappeared with the near annihilation of its regional network. This will likely encourage China to seek deeper ties with other Middle Eastern heavyweights, like Saudi Arabia and the United Arab Emirates, in accomplishing its goals in the Middle East — chief among them, increasing its regional influence at the expense of the U.S.

But it’s also unlikely China will entirely abandon Iran. While it may focus its most concerted efforts on developing deeper ties with other Middle Eastern countries instead of Iran, China would likely be hesitant to see Iran become even further isolated and therefore more predisposed to behaving aggressively.

China was one of the main behind-the-scenes mediators of the 2015 Iran nuclear deal because it wanted regional tensions to dissipate via Iran’s abandonment of its nuclear program.

Iranian Supreme Leader Ayatollah Ali Khamenei in Tehran, in May 2024.

(AP Photo/Vahid Salemi)

Now that Iran is weakened, it has essentially been boxed into a corner, and has two main options moving forward: either it achieves a rapprochement with the West, or it reinvigorates its nuclear program and acts more aggressively.

While Iran’s ultra-conservative factions that control the levers of power in the country may be tempted to take a more aggressive path, it is very possible China will attempt to use its substantial economic leverage over Iran to encourage them to pursue the rapprochement option.

That’s because the Chinese need the Middle East as a source of petroleum to fuel their economy, and because China doesn’t want to be viewed by the West as an implicit accomplice to a bellicose and destabilizing Iran.

China a moderating influence?

On the contrary, China is currently attempting to repair relations with many western countries given the importance of the West’s markets to China’s ailing economy.

In fact, China may wish to play a role in inducing Iran to strike a deal with the West in the near future, given that it would show the incoming Donald Trump administration — which is notoriously hawkish on China — that it can be trusted and worked with constructively.

At the end of the day, China will seek the path that minimizes the likelihood of full-blown conflict in the Middle East given the importance of the region to the Chinese economy. The country has a strategic opportunity to signal trustworthiness and dependability to the West by working to prevent Iran from choosing a more aggressive path.

This article is republished from The Conversation under a Creative Commons license. Read the original article.