Economics

2008: Defining common goals through deliberation

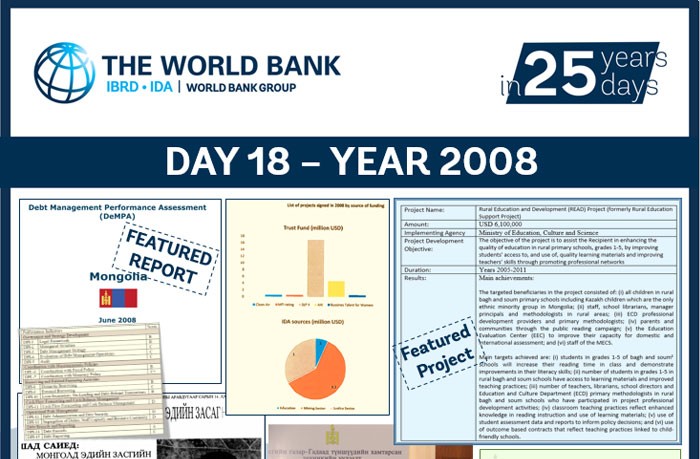

Continuing with our series looking at the 25 year partnership between Mongolia and the World Bank, today we look at 2008, a year that will be remembered by many Mongolians for events both high and low. The low point was the riot that followed parliamentary elections on 1st July, 2008. Five innocent lives were lost and Ulaanbaatar city was under a state emergency for two days and three nights. While Mongolia is rightfully praised for its peaceful transition from one regime to another in 1990, this incident of 2008 will be remembered as the darkest time in the 25 years of democracy.

The high of 2008 occurred after this riot when Mr. Tuvshinbayr Naidan brought home Mongolia’s 1st ever gold medal from the Beijing summer Olympics. I will never forget the sight of people waving our national flag, gathering in the Central Square and cheering with exhilaration. The World Bank’s Country Director, David Dollar, also celebrated this historic occasion, noting that “The event was important enough to get rival political parties to shake hands and share the pride.”

The year 2008 also brought some important highlights for Mongolia’s partnership with the World Bank. A multi-stakeholder forum called the Economic Policy Conference was held in 2008, and this was right time for Mongolia. According to Mr. Bayartsogt, the Minister of Finance at that time, Mongolia’s foreign reserves had reached US$1 billion and economic growth had taken off since 1990. The mining sector was expected to grow rapidly, and an increase of foreign investment was anticipated, yet the country was facing economic challenges. The conference, which was suggested by the World Bank and accepted by the new Government established in 2008, sought to bring policy makers, researchers, investors and government officials together to generate a discussion on the current economic situation, to consider areas of improvement in regard to strengthening foreign investment, and to exchange international best practices in mining sector development. A high level delegation visited Mongolia to participate, including Justin Lin, Chief Economist of the World Bank, Yegor Gaidar, former Prime Minister of Russia, and Jim Adams, World Bank Vice President for East Asia and the Pacific. The meeting became a regular event from 2009 onwards and laid the groundwork for what would later become the Mongolia Economic Forum, now led by non-government organization. Creating a platform to discuss national level issues was an important step forward for Mongolia. Mongolia has a proverb “It is better if we discuss all together”.

In the same year, the World Bank endorsed several new projects funded by IDA and trust funds. The Mining Sector Institutional Strengthening Technical Assistance Project (MISISTAP) aimed to strengthen the capacity to manage mining revenues and develop economic and sector policies, to improve regulatory capacity to manage mining sector development, and to developing the capacity for management of state equity. An Enhanced Justice Sector Services Project was also approved that year. While…

Business

Gordonstoun Severs Connections with Business Led by Individual Accused of Espionage for China

Gordonstoun school severed ties with Hampton Group over espionage allegations against chairman Yang Tengbo. He denies involvement and claims to be a victim of political tensions between the UK and China.

Allegations Lead to School’s Decision

Gordonstoun School in Moray has cut ties with Hampton Group International after serious allegations surfaced regarding its chairman, Yang Tengbo, who is accused of being a spy for the Chinese government. Known by the alias "H6," Mr. Tengbo was involved in a deal that aimed to establish five new schools in China affiliated with Gordonstoun. However, the recent allegations compelled the school to terminate their agreement.

Public Denial and Legal Action

In response to the spying claims, Mr. Tengbo publicly revealed his identity, asserting that he has committed no wrongdoing. A close associate of Prince Andrew and a former Gordonstoun student himself, Mr. Tengbo has strenuously denied the accusations, stating that he is a target of the escalating tensions between the UK and China. He has claimed that his mistreatment is politically motivated.

Immigration Challenges and Legal Responses

Yang Tengbo, also known as Chris Yang, has faced additional challenges regarding his immigration status in the UK. After losing an appeal against a ban enacted last year, he reiterated his innocence, condemning media speculation while emphasizing his commitment to clear his name. Gordonstoun, on its part, stated its inability to divulge further details due to legal constraints.

Source : Gordonstoun cuts ties with business chaired by man accused of spying for China

Business

China Dismantles Prominent Uyghur Business Landmark in Xinjiang – Shia Waves

The Chinese government demolished the Rebiya Kadeer Trade Center in Xinjiang, affecting Uyghur culture and commerce, prompting criticism from activists amid concerns over cultural erasure and human rights violations.

Demolition of a Cultural Landmark

The Chinese government recently demolished the Rebiya Kadeer Trade Center in Urumqi, Xinjiang, a vital hub for Uyghur culture and commerce, as reported by VOA. This center, once inhabited by more than 800 predominantly Uyghur-owned businesses, has been deserted since 2009. Authorities forcibly ordered local business owners to vacate the premises before proceeding with the demolition, which took place without any public notice.

Condemnation from Activists

Uyghur rights activists have condemned this demolition, perceiving it as part of China’s broader strategy to undermine Uyghur identity and heritage. The event has sparked heightened international concern regarding China’s policies in Xinjiang, which have been characterized by allegations of mass detentions and cultural suppression, prompting claims of crimes against humanity.

Rebiya Kadeer’s Response

Rebiya Kadeer, the center’s namesake and a notable Uyghur rights advocate, criticized the demolition as a deliberate attempt to erase her legacy. Kadeer, who has been living in exile in the U.S. since her release from imprisonment in 2005, continues to advocate for Uyghur rights. She has expressed that her family members have suffered persecution due to her activism, while the Chinese government has yet to comment on the legal ramifications of the demolition.

Source : China Demolishes Uyghur Business Landmark in Xinjiang – Shia Waves

Business

Yakult Unveils Restructuring Plans for Its China Operations | ESM Magazine

Yakult reorganized its China operations, dissolving the Shanghai subsidiary while opening a new branch. Manufacturing now consolidates at Wuxi and Tianjin plants, aiming for enhanced efficiency and growth.

Yakult’s Business Reorganisation in China

Yakult has announced a significant reorganisation of its operations in China, aiming to enhance competitiveness and sustainability. The company has dissolved its wholly-owned subsidiary, Shanghai Yakult, which previously managed manufacturing and sales functions. This strategic move is expected to streamline its operations in the Chinese market.

New Branch and Manufacturing Adjustments

Yakult’s head office in China has established a new branch in Shanghai, transferring the sales division from Shanghai Yakult to this location. As of December 6, the branch has started selling various products, including Yakult and its light variants. Meanwhile, the manufacturing plant in Shanghai has ceased operations, with production capacity now absorbed by the Wuxi and Tianjin plants to ensure efficient supply.

Commitment to Growth

The company remains steadfast in its dedication to the Chinese market and is optimistic about future growth. Yakult reassured stakeholders that the reorganisation will have minimal financial impact and aims to enhance efficiency. Founded in 2005 in Shanghai, Yakult China currently employs approximately 2,216 individuals, reinforcing its commitment to customer health and expanding operations.

Source : Yakult Announces Reorganisation Of China Business | ESM Magazine