Trade

A chance for Chinese economic leadership

Authors: Peter A Petri, Brandeis University and Michael G Plummer, Johns Hopkins University

In late June 2020, 15 East Asian countries — representing nearly 30 per cent of the world’s economic output and population — committed to signing the Regional Comprehensive Economic Partnership (RCEP) in November. This will be the largest free trade agreement ever and complements the 2018 Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

The United States is missing from these agreements, having left the predecessor of the CPTPP (the Trans-Pacific Partnership) when US President Donald Trump took office. India, originally a member of the RCEP negotiations, withdrew just before the agreement’s conclusion. These departures hand China potent leverage — it is the largest economy in a now regionally focussed East Asian system.

Will China use this leverage to advance short-term political interests — a kind of ‘China first’ strategy — or to build a rules-based system that works for all countries as a model for global cooperation? How Chinese leaders answer this question will shape the economic and political landscape for years to come.

Simulations reveal the US–China trade war will reduce world incomes by US$301 billion annually, and world trade by nearly US$1 trillion annually, by 2030 from what they would be with pre-Trump policies. Nearly three-quarters of the decline in trade will consist of transactions across the Pacific.

In contrast, the CPTPP and RCEP could add US$121 billion and US$209 billion to global incomes, respectively, if they are implemented as planned. These gains — due to additional trade and production in East Asia — would offset the effects of the trade war for the region, if not fully for China and the United States. The agreements will reduce the cost of doing business and strengthen technology, manufacturing, agriculture and natural resources cooperation in East Asia. They will also deepen linkages among China, Japan and South Korea, which are among each other’s largest trade partners.

The Chinese Belt and Road Initiative will also reinforce these relationships. It will offer US$1.4 trillion in investments for transport, energy and communications infrastructure to neighbouring economies. US Secretary of State Mike Pompeo’s offer of US$113 million in US investments highlights the gulf between Chinese and US priorities. The United States used to counter aid with good access to its markets but is now retreating into mercantilism.

RCEP and the CPTPP make East Asia a natural sphere of Chinese economic influence and will generate skewed benefits. China will gain the most from RCEP (US$100 billion), followed by Japan (US$46 billion) and South Korea (US$23 billion). Southeast Asia will also benefit (US$19 billion), but less since ASEAN already has free trade accords in place with its RCEP partners. The United States and India will forego gains of US$131 billion and US$60 billion, respectively.

The big question is how China will manage its new economic role. Some in China see compromise with other countries as unnecessary beyond the need for essential trade. That may explain policies to coerce even well-disposed trade partners to support China politically — for example, by warning Chinese students away from Australia, presumably in retaliation for Australian support for an inquiry into the COVID-19 pandemic.

But other Chinese leaders understand that the country faces acute international pushback. Regional concerns are well known and include a range of Chinese policies, from Hong Kong to the South China Sea, backed by a new ‘wolf warrior’ approach to diplomacy that alienates rather than persuades.

The Trump administration also pursues many unacceptable objectives and uses deeply alienating speech. But these do not change the fact that China cannot grow its regional or global influence by acting as an ‘unencumbered power’. Nor can East Asia become a regional model while many see China as a rising threat.

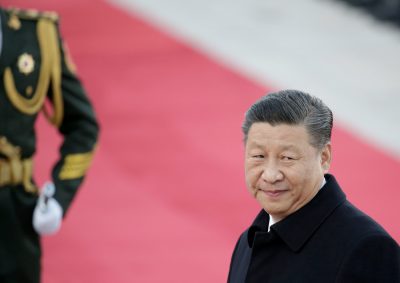

China’s interest in collaboration gained momentum in recent years, as suggested by accelerating dialogue with neighbouring leaders. China–Japan–South Korea trilateral meetings resumed in 2018. This set the stage for a state visit by Chinese President Xi Jinping to Japan in April 2020, which was postponed due to COVID-19 and is now at risk of being cancelled in protest against the new Hong Kong national security law. Working with China is becoming a political liability for many regional leaders.

In these dysfunctional times, a new and…

Trade

Self-Reliance and Openness: Core Principles of China’s Third Plenary Session

The Third Plenum communique from the CCP indicates a prioritization of stability and compromise in response to China’s economic challenges. It highlights the concept of Chinese-style modernization and establishes political guidelines for balancing regulation and market forces.

The CCP’s Third Plenum communique signals a focus on stability and compromise in the face of China’s economic challenges. It emphasises Chinese-style modernisation and sets political directions for balancing regulation and market forces. While not as groundbreaking as previous plenums, it acknowledges the importance of market mechanisms and technological self-reliance, aiming to address issues like high youth unemployment and private sector uncertainty. The communique seeks to navigate the complexities of global competition and domestic innovation, potentially reshaping global supply chains and trade dynamics. Overall, it presents a pragmatic blueprint for China’s economic future.

Source : Self-reliance and openness central pillars of China’s Third Plenum | East Asia Forum

Trade

Trade Prevails Over Political Persuasions in China-Germany Relations

China and Germany maintain a strong bilateral relationship, rooted in economic cooperation despite ideological differences. Recent visits and agreements focus on expanding trade and addressing mutual concerns, navigating challenges while nurturing ties.

Evolving Bilateral Ties

China and Germany share a strong bilateral relationship, rooted in history since 1972. This connection has seen moments of cooperation intertwined with periods of tension. German Chancellor Olaf Scholz’s April 2024 visit underscores Germany’s commitment to fostering this partnership, reflecting a mutual interest in maintaining economic ties despite ideological differences.

Economic Pragmatism

As the second and third largest global economies, China and Germany’s economic interdependence is crucial. Germany emerged as China’s primary trading partner in 2023, with trade values reaching €254.4 billion (US$280 billion). In response to global scrutiny, Germany has taken a balanced approach, emphasizing economic stability over political discord. This was evident during Scholz’s prior visit in November 2022, where his diplomatic tone contrasted with broader EU sentiments.

Facing Challenges Together

Despite increasing public skepticism in Germany regarding China’s global influence and human rights issues, both nations continue to seek common ground. Their October 2023 Joint Statement highlights intentions to pursue cooperation in areas like carbon neutrality and open markets. To navigate these complex terrains, Germany can utilize its institutional frameworks to enhance dialogue, while also considering supply chain diversification to reduce dependency on China. The intertwining nature of their economies suggests that, despite challenges, both countries will continue to prioritize their substantial trade relations.

Source : Trade trumps political persuasions in China–Germany relations

Trade

Fixing fragmentation in the settlement of international trade disputes

Fragmentation in global trade due to the lack of development in multilateral trade rules at the WTO has led to an increase in FTAs. The Appellate Body impasse has further exacerbated fragmentation, requiring a multilateral approach for reform.

Fragmentation in Global Trade

Fragmentation in global trade is not new. With the slow development of multilateral trade rules at the World Trade Organization (WTO), governments have turned to free trade agreements (FTAs). As of 2023, almost 600 bilateral and regional trade agreements have been notified to the WTO, leading to growing fragmentation in trade rules, business activities, and international relations. But until recently, trade dispute settlements have predominantly remained within the WTO.

Challenges with WTO Dispute Settlement

The demise of the Appellate Body increased fragmentation in both the interpretation and enforcement of trade law. A small number of WTO Members created the Multi-Party Interim Appeal Arbitration Arrangement (MPIA) as a temporary solution, but in its current form, it cannot properly address fragmentation. Since its creation in 2020, the MPIA has only attracted 26 parties, and its rulings have not been consistent with previous decisions made by the Appellate Body, rendering WTO case law increasingly fragmented.

The Path Forward for Global Trade

Maintaining the integrity and predictability of the global trading system while reducing fragmentation requires restoring the WTO’s authority. At the 12th WTO Ministerial Conference in 2022, governments agreed to re-establish a functional dispute settlement system by 2024. Reaching a consensus will be difficult, and negotiations will take time. A critical mass-based, open plurilateral approach provides a viable alternative way to reform the appellate mechanism, as WTO Members are committed to reforming the dispute settlement system.

Source : Fixing fragmentation in the settlement of international trade disputes